আরও দেখুন

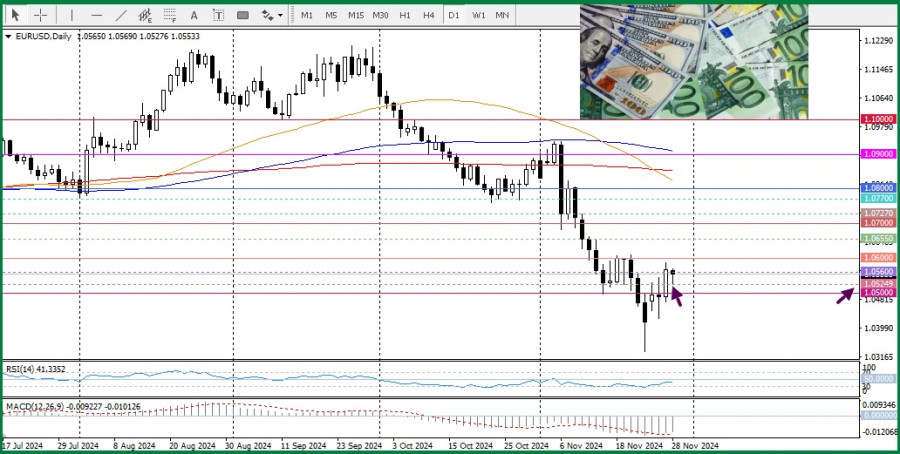

Today, the EUR/USD pair fell to approximately 1.0525 during the European session.

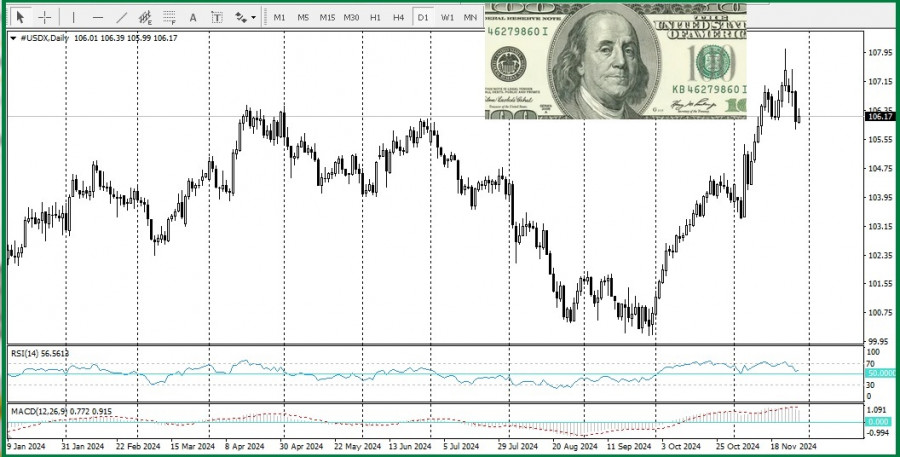

This decline is attributed to a modest increase in U.S. Treasury yields and stronger demand for the dollar. The U.S. dollar is recovering, partially reversing the previous day's decline from a two-week low.

According to the latest U.S. inflation report, consumer spending experienced solid growth in October. However, the report also highlighted stagnation in progress toward reducing inflation, keeping the Federal Reserve cautious. The CME FedWatch tool suggests a 68.1% chance of a quarter-point rate cut by the Federal Reserve in December, up from 59.4% the previous day. Analysts, however, expect the Fed to keep rates steady at the January and March meetings.

Due to the Thanksgiving holiday in the U.S., market liquidity is likely to be reduced today.

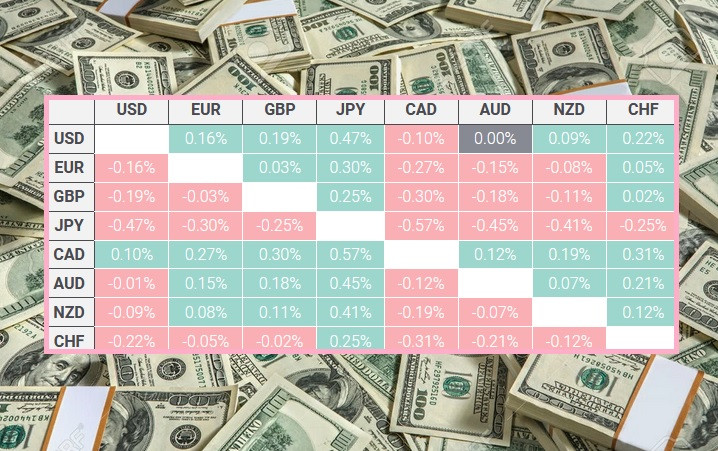

Today, the U.S. dollar showed the strongest performance against the Japanese yen among major currencies.

European Central Bank policymakers have raised concerns about the eurozone's current and future economic growth. A December rate cut by the ECB is considered likely, though opinions vary on the potential size of the reduction. Traders will now focus on Friday's release of eurozone inflation data from the Harmonized Index of Consumer Prices (HICP), which could significantly influence market sentiment. During today's North American session, the German Consumer Price Index (CPI) — a key indicator for the eurozone's largest economy — will be published. This data could impact the pair's movement, particularly in the context of reduced U.S. market liquidity.

From a technical perspective, oscillators on the daily chart remain in negative territory and have yet to confirm a positive outlook. Therefore, it is too early to conclude that the recovery from the yearly low will continue.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।