USDNOK (US Dollar vs Norwegian Krone). Exchange rate and online charts.

Currency converter

25 Mar 2025 00:36

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USDNOK stands for the United States dollar vs. the Norwegian krone currency pair. The Norwegian krone is among the most popular non-major currencies. In 2000, the pair got significantly stronger, mostly because of oil prices flying higher. Moreover, the economic policy of Norway added much to the pair reputation, as during the global economic crisis the country got the less damage in the sector of economy due to wise investments of the country’s monetary policy makers. The following factors are of chief importance for the Norwegian krone: the oil prices, the country’s credit rating and the overall stance of the currency market.

It should be noted that Norway is one of the largest oil exporters in the Western Europe, and is strongly dependent on the energy market climate.

The rate of the Norwegian krone versus the United States dollar has demonstrated a steady climb over the last decade. For example, in 2001 the correlation between the currencies was as follows: one American dollar cost nine Norwegian kroner. However, in ten years one dollar was bought for less than 6 kroner.

The dynamics of the American dollar rate is mainly determined by the macroeconomic indicators of the country. The greenback’s unpredictable and strong fluctuations make it the most often used currency on Forex, especially by speculators who prefer short trades with the purpose of getting high yield within a narrow time.

The USDNOK pair fundamental analysis is based on the American dollar rate. If the USD confidence is low, the pair is to move downwards.

See Also

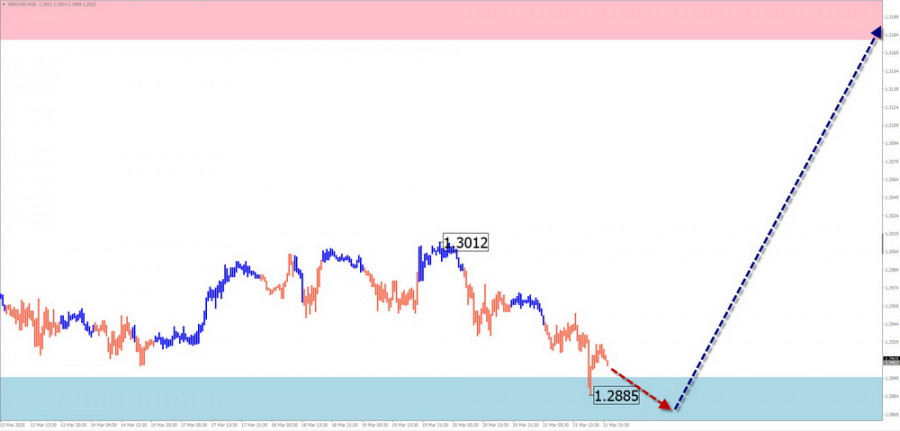

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1108

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

853

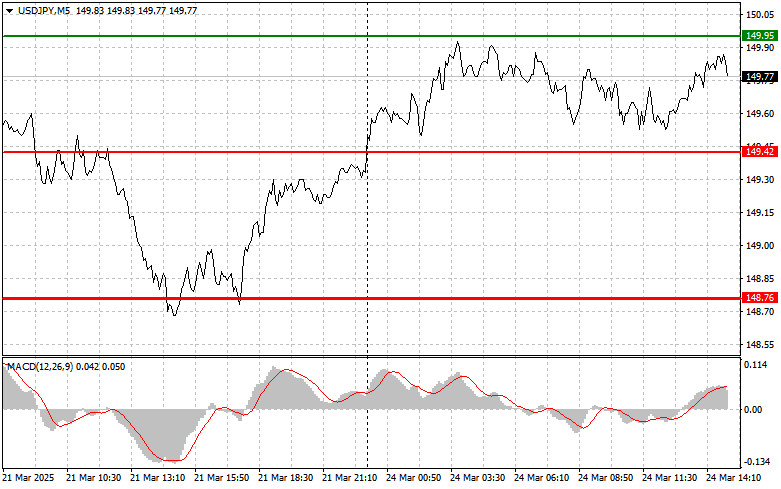

USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)Author: Jakub Novak

17:13 2025-03-24 UTC+2

853

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

838

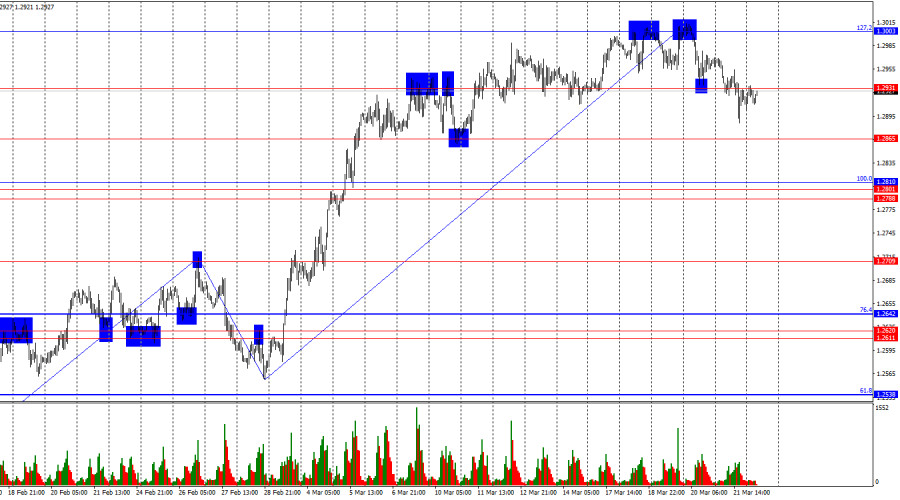

The outcomes of the Bank of England and FOMC meetings contradicted each other.Author: Samir Klishi

12:25 2025-03-24 UTC+2

793

Technical analysisTrading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

733

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

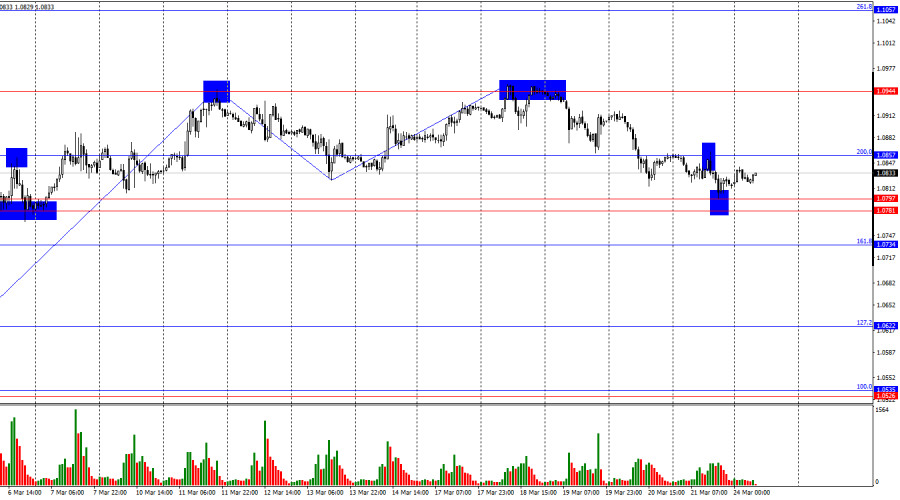

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

733

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

718

Diverging expectations regarding the policies of the Bank of Japan and the Federal Reserve may limit further growth of the pair.Author: Irina Yanina

14:20 2025-03-24 UTC+2

688

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1108

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

853

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

853

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

838

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

793

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

733

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

733

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

718

- Diverging expectations regarding the policies of the Bank of Japan and the Federal Reserve may limit further growth of the pair.

Author: Irina Yanina

14:20 2025-03-24 UTC+2

688