26.07.2022 09:37 PM

26.07.2022 09:37 PMThe EUR/USD pair plunged as the Dollar Index managed to rebound. It was traded at 1.0120 at the time of writing and it seems vulnerable to slide further. In the short term, it has moved sideways but it has failed to confirm a larger growth.

As you already know, the rate registered a leg higher only because the Dollar Index was in a corrective phase. Yesterday, the German ifo Business Climate and the Belgian NBB Business Climate reported worse than expected data.

Surprisingly or not, the EUR/USD pair is bearish even if the US CB Consumer Confidence came in at 95.7 points below 97.3 expected, New Home Sales dropped from 642K to 590K, while the HPI rose by 1.4% less versus 1.5% expected. Tomorrow, the FOMC could change the sentiment. The FED is expected to increase the Federal Funds Rate from 1.75% to 2.50%.

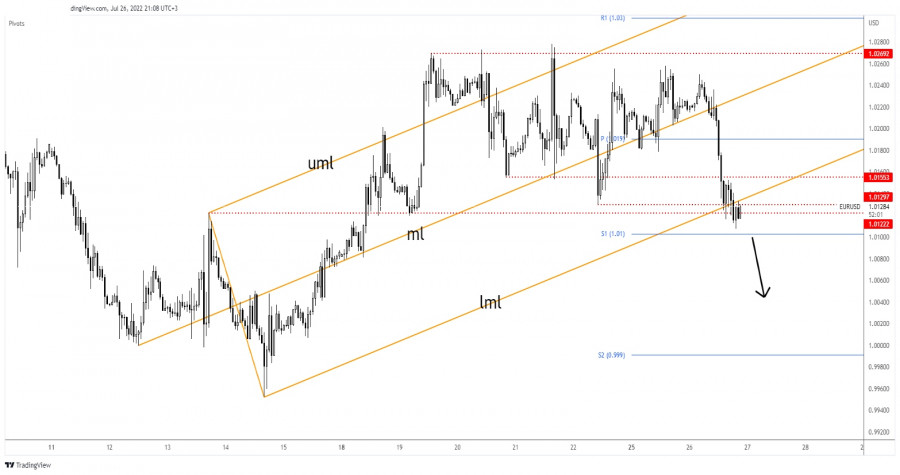

EUR/USD found resistance at 1.0269 and now it has dropped below 1.0155, 1.0129, and under 1.0122 downside obstacles. Also, the price ignored the lower median line (lml) of the ascending pitchfork which represented a downside obstacle.

Its failure to make a new higher high or to approach and reach the 1.0269 in the last attempts signaled exhausted buyers. Stabilizing below the lower median line (lml) should activate more declines.

The next downside obstacle is represented by the weekly S1 (1.0100). Taking out this level may announce a further drop. So, dropping and stabilizing below this support level could help the sellers to catch a larger drop.

Still, in the short term, we cannot exclude a temporary rebound after its massive drop. Testing and retesting the lower median line (lml) could bring us new short opportunities from the highs.

當MACD指標剛剛從零點向上移動時,測試142.79水準,這確認了一個有效的買入美元進場點。因此,該貨幣對僅上升了15個點。

當測試1.3230水準時,MACD指標已經顯著高於零線,這限制了英鎊上行的潛力。基於這個原因,我沒有進行買入。

當MACD指標已經顯著超過零點時,測試1.1385水準,這限制了匯對的上升潛力。因此,我沒有購買歐元。

當價格觸及142.69時,MACD指標正從零線上升,確認了美元的合適買入點。因此,該貨幣對僅上升了15點。

歐元交易回顧與交易指導 在今天上半場,並未測試到我所說明的水平。即便發佈了重要的通脹數據,市場波動性減少導致該匯對未能達到這些參考水平。

在價格於142.93進行測試時,MACD指標剛從零刻度開始下行,確認了一個有效的賣出美元進場點。因此,該貨幣對下降了30點才放緩壓力。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.