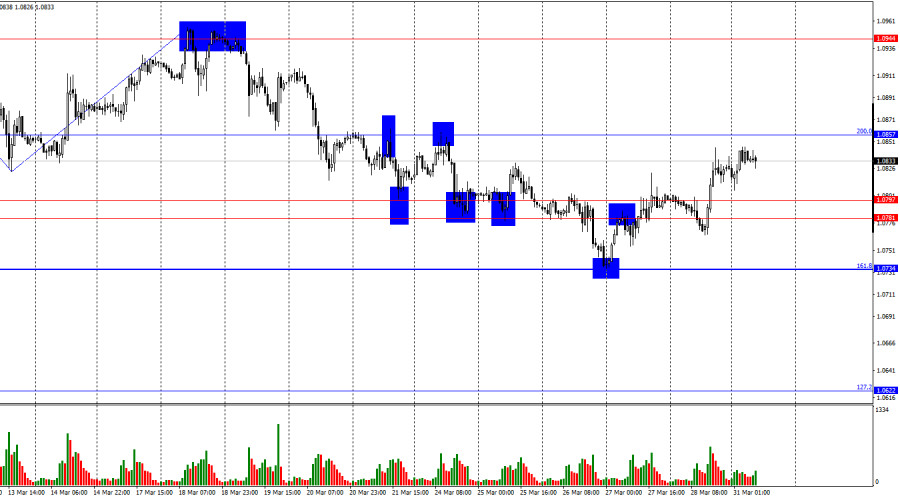

EURCHF (Euro vs Swiss Franc). Exchange rate and online charts.

Currency converter

31 Mar 2025 19:01

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

EUR/CHF is the cross rate against the US dollar. Although the US Dollar is not present in this currency pair, it still has significant impact upon it. This can be seen if you combine two charts ― EUR/USD and USD/CHF. By combining these two charts in the same price chart, you will get an approximate EUR/CHF chart.

The U.S. dollar influences both currencies. For this reason, it is necessary to take into account major U.S. economic indicators to correctly predict a future behaviour of this financial instrument. These indicators include the discount rate, GDP, unemployment, new vacancies and many others. It is worth noting that the discussed currencies could respond to U.S. economic changes with different speed. Therefore, the EUR/CHF pair may be a specific indicator of changes in these currencies.

The EUR/CHF chart tends to remain unchanged for a long time. That is why this financial instrument is not so popular with traders, who cannot earn enough on such a market. However, when the currency pair moves from a passive into an active state, trends can be observed. Opening a deal makes sense. At the same time, the trader must first learn the spread size for this currency pair and the margin size for the deal otherwise the deal can be very expensive.

Switzerland is a highly developed and rich country. Goods produced in this country are mostly directed to foreign markets, but the most progressive economic sector of Switzerland is banking system with major banks being UBS and Credit Suisse.

The economic situation in Switzerland has been stable for several centuries. For this reason, the Swiss franc enjoys great confidence worldwide as one of the most reliable currencies. The Swiss franc is also a kind of a safe haven for capital investment during the crisis. Therefore, in times of crisis, when capital is urgently forwarded to Switzerland, the Swiss franc surges against its counterparts. This feature of Swiss economy should be taken into account when you trade this instrument.

Speaking about Switzerland’s monetary policy, announcement by the National Bank of Switzerland meeting outcomes is of great importance. However, information about the state of the Swiss economy is rarely advertised. Therefore, any information concerning the economic situation in Switzerland absorbs attention of traders around the world.

The main feature of the Swiss banking system is the complete confidentiality of customer accounts allowing clients to evade taxes. The European Union has repeatedly urged Switzerland to make its banking system more open, but the country is still not able to do it. The franc can fall in price at reducing exports in Western Europe.

See Also

- West Texas Intermediate (WTI) crude oil prices are attempting to attract buyers, but the market remains in a state of uncertainty.

Author: Irina Yanina

12:39 2025-03-31 UTC+2

943

At the start of the new week during the Asian session, the EUR/USD pair attempted to attract buyers, but this was unsuccessful.Author: Irina Yanina

12:35 2025-03-31 UTC+2

793

Technical analysis / Video analyticsForex forecast 31/03/2025: EUR/USD, GBP/USD, Gold, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, Gold, Oil and Bitcoin.Author: Sebastian Seliga

10:50 2025-03-31 UTC+2

763

- Bulls decided to retreat slightly, but Trump put a stop to it

Author: Samir Klishi

11:58 2025-03-31 UTC+2

763

Nikkei Falls 4%, Nasdaq Futures Fall 1.4% Trump Says U.S. Tariffs Will Apply to Every Country Gold Has Best Quarter Since 1986 Dollar Heading for Worst First Quarter Since Global Financial CrisisAuthor: Thomas Frank

09:35 2025-03-31 UTC+2

718

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, and #Ripple – March 31

In the coming days, a completion of the downward movement in the euro exchange rate is likely, potentially reaching the lower boundary of the calculated support zone. A reversal and renewed upward momentum are expected in the second half of the week.Author: Isabel Clark

11:12 2025-03-31 UTC+2

688

- Trading Recommendations for the Cryptocurrency Market on March 31

Author: Miroslaw Bawulski

11:02 2025-03-31 UTC+2

658

Bears failed to show anythingAuthor: Samir Klishi

12:28 2025-03-31 UTC+2

658

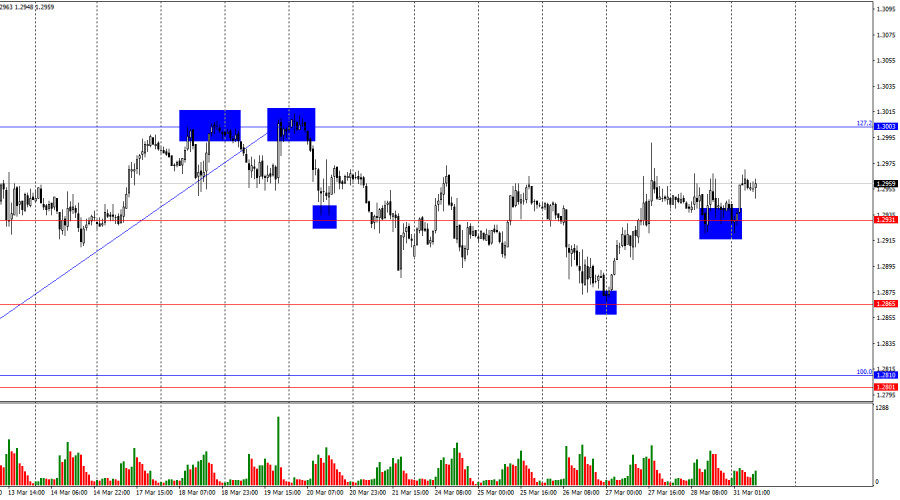

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, and #Litecoin as of March 31

In the coming days, a flat phase in the movement of the British pound is expected to come to an end. In the second half of the week, a reversal may form near the support zone, followed by a renewed upward price movement.Author: Isabel Clark

11:43 2025-03-31 UTC+2

658

- West Texas Intermediate (WTI) crude oil prices are attempting to attract buyers, but the market remains in a state of uncertainty.

Author: Irina Yanina

12:39 2025-03-31 UTC+2

943

- At the start of the new week during the Asian session, the EUR/USD pair attempted to attract buyers, but this was unsuccessful.

Author: Irina Yanina

12:35 2025-03-31 UTC+2

793

- Technical analysis / Video analytics

Forex forecast 31/03/2025: EUR/USD, GBP/USD, Gold, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, Gold, Oil and Bitcoin.Author: Sebastian Seliga

10:50 2025-03-31 UTC+2

763

- Bulls decided to retreat slightly, but Trump put a stop to it

Author: Samir Klishi

11:58 2025-03-31 UTC+2

763

- Nikkei Falls 4%, Nasdaq Futures Fall 1.4% Trump Says U.S. Tariffs Will Apply to Every Country Gold Has Best Quarter Since 1986 Dollar Heading for Worst First Quarter Since Global Financial Crisis

Author: Thomas Frank

09:35 2025-03-31 UTC+2

718

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, and #Ripple – March 31

In the coming days, a completion of the downward movement in the euro exchange rate is likely, potentially reaching the lower boundary of the calculated support zone. A reversal and renewed upward momentum are expected in the second half of the week.Author: Isabel Clark

11:12 2025-03-31 UTC+2

688

- Trading Recommendations for the Cryptocurrency Market on March 31

Author: Miroslaw Bawulski

11:02 2025-03-31 UTC+2

658

- Bears failed to show anything

Author: Samir Klishi

12:28 2025-03-31 UTC+2

658

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, and #Litecoin as of March 31

In the coming days, a flat phase in the movement of the British pound is expected to come to an end. In the second half of the week, a reversal may form near the support zone, followed by a renewed upward price movement.Author: Isabel Clark

11:43 2025-03-31 UTC+2

658