See also

26.05.2023 04:15 AM

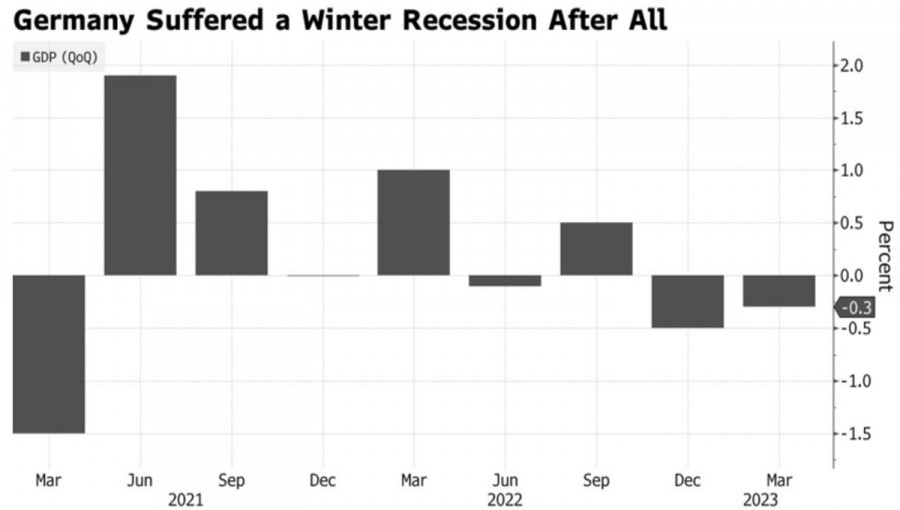

26.05.2023 04:15 AMBack in January, the German government ruled out the possibility of a recession, but the fall in German GDP increases the threat of recession. Weak consumer activity and cuts in government spending led to a 0.3% decrease in German GDP in the first quarter. With a 0.5% decrease from October to December, the first recession since the end of the pandemic has arrived. This circumstance has dealt a heavy blow to EUR/USD.

Initially, there was talk of stagnation, but now it is a decline. Moreover, the scale of the revision was so significant that it increases the risks of the entire currency bloc sliding into a recession. Just as the market began to discuss the possibility of avoiding a decline in European GDP, a dark streak arrived.

Germany's economic dynamics

Trouble doesn't come alone. The collapse of European PMIs and the unpleasant surprise of German GDP are just one side of the coin. The other side is in Asia. According to the latest data, it is unlikely that China's economy will grow significantly above the official target of 5% in 2023. And many investors, especially fans of EUR/USD, were hoping for more. They wanted China to become the locomotive of the global economy after coming out of lockdowns and to help the export-oriented eurozone.

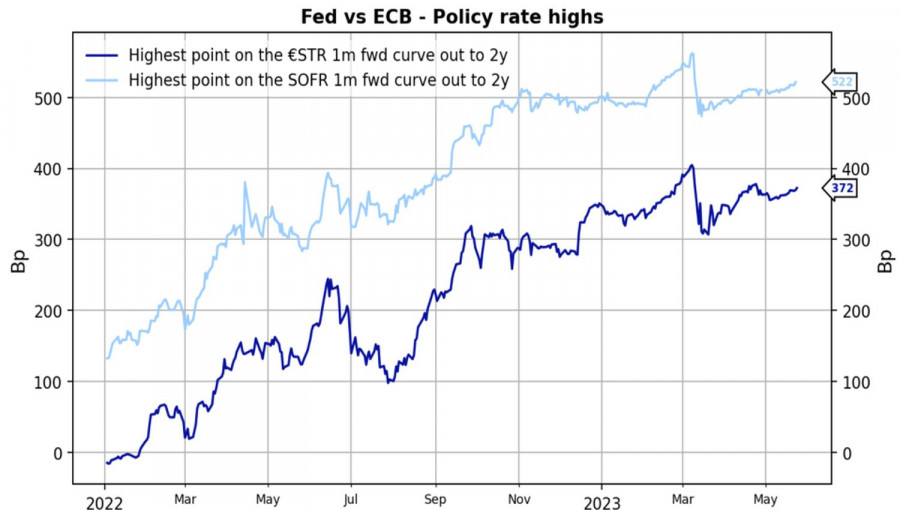

Thus, the rapidly increasing risks of a recession in the bloc and China's sluggish recovery put an end to the attempts of the main currency pair to bring back the uptrend. Especially considering the weakness of the European economy, it is unlikely that the European Central Bank will decide to raise the deposit rate above the market's expected 3.75%.

Market expectations for ECB and Fed interest rates dynamics

As for the market's forecasts for the Fed's policy rate ceiling at 5.25%, USD supporters are not afraid of this. Morgan Stanley notes that the US dollar typically rises after the end of a monetary tightening cycle and recommends its clients to open short positions on EUR/USD with 1.03 as the target.

It's not certain that the monetary tightening cycle is over. FOMC member Christopher Waller believes that even if borrowing costs do not rise in June, they will definitely increase during the remainder of the year. Derivatives assess the chances of a rate hike in July at 63%. The Fed is currently benefiting from taking a pause and assessing the consequences of its actions. If US macro data do not worsen, the Fed can go back to being aggressive.

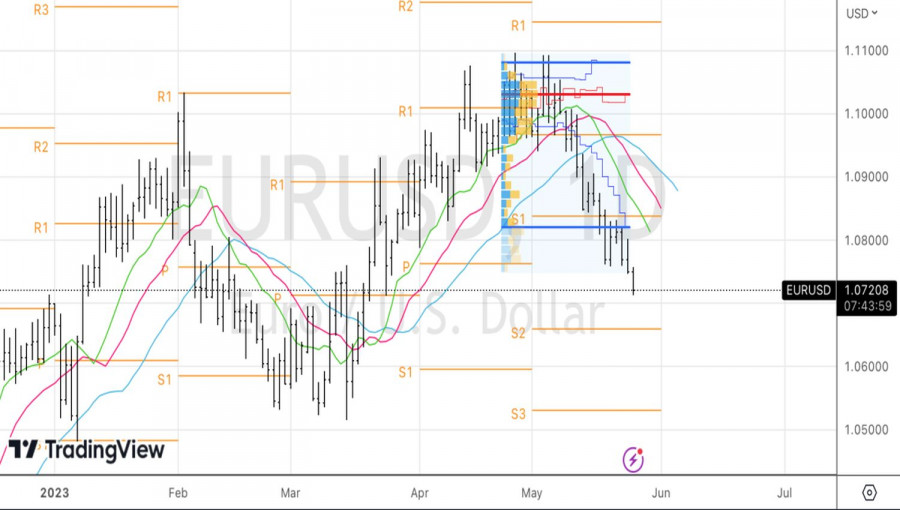

Thus, disappointing data from major competitors of the US, such as the eurozone and China, the resilience of the American economy, and hints from Fed representatives that the rate hike cycle is not over, does not only create conditions for a correction, but also for breaking the uptrend in the main currency pair.

Technically, the pullback in EUR/USD is gaining momentum. The first target for shorts at 1.071 is within arm's reach. We continue to sell the euro towards the remaining two targets at $1.066 and $1.053.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Market optimism, fueled by Donald Trump's active manipulation of the tariff narrative, was short-lived. Traders remain focused on the escalating tensions between the U.S. and China following the U.S. Department

A few macroeconomic events are scheduled for Wednesday, but some important reports will be released. However, the current key issue is not the reports' significance but how the market will

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.