See also

12.06.2023 12:09 PM

12.06.2023 12:09 PMThe British pound is effectively leveraging its advantages. The UK economy is likely to avoid a recession, which distinguishes the sterling from the euro. Looking at a strong labor market and rapid wage growth, the Bank of England will continue to raise the repo rate above 5%. The divergence in monetary policy with the Federal Reserve (Fed) contributes to a rally in GBP/USD. The pair has reached monthly highs, which, amid the calmness of the Forex market before the storm, indicates serious bullish intentions.

The Confederation of British Industry has raised its UK GDP forecast from -0.4% to +0.4% in 2023 and from +1.6% to +1.8% in 2024. The main reasons cited are the recovery of the Chinese economy after COVID-19-related restrictions and the easing of disruptions in global supply chains. According to Bloomberg experts, the British economy is expected to expand by 0.3% in April after contracting by 0.3% in March, essentially signaling stagnation. However, the fact that a recession will be avoided provides support for GBP/USD.

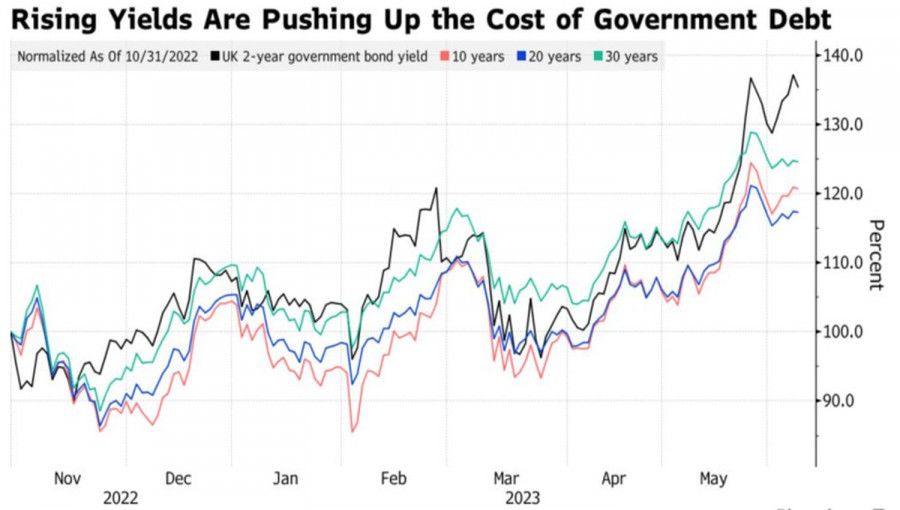

Expectations of an acceleration in average wages from 5.8% to 6.1% over three months through April are driving the pound upward. These expectations are related to a 9.7% increase in the minimum wage in mid-spring, which has benefited around 1.6 million people in the UK. The strength of the labor market is a strong argument for raising the repo rate above 5%, contributing to a rally in UK bond yields and GBP/USD quotes.

Dynamics of British bond yields

Thus, the sterling is playing its own cards, taking advantage of the consolidation of the U.S. dollar ahead of important releases of U.S. inflation data for May and the Fed's meetings. Bloomberg experts predict a slowdown in consumer prices from 4.9% to 4.1%. However, this should not be misleading. Core inflation will decrease from 5.5% to 5.2% but will remain elevated. Monthly CPI will accelerate to 0.4%.

As for the Federal Reserve's meeting, the futures market expects the rate to be maintained at 5.25% in June, with a subsequent increase to 5.5% in July. It is likely that Jerome Powell will adopt a hawkish rhetoric during his press conference, and the FOMC's rate forecasts will be raised. In theory, this should lead to an increase in Treasury bond yields and a strengthening of the U.S. dollar. However, any surprises are possible.

In my opinion, the persistence of high U.S. inflation combined with signals from the Fed about further rate hikes will limit the potential for a GBP/USD rally.

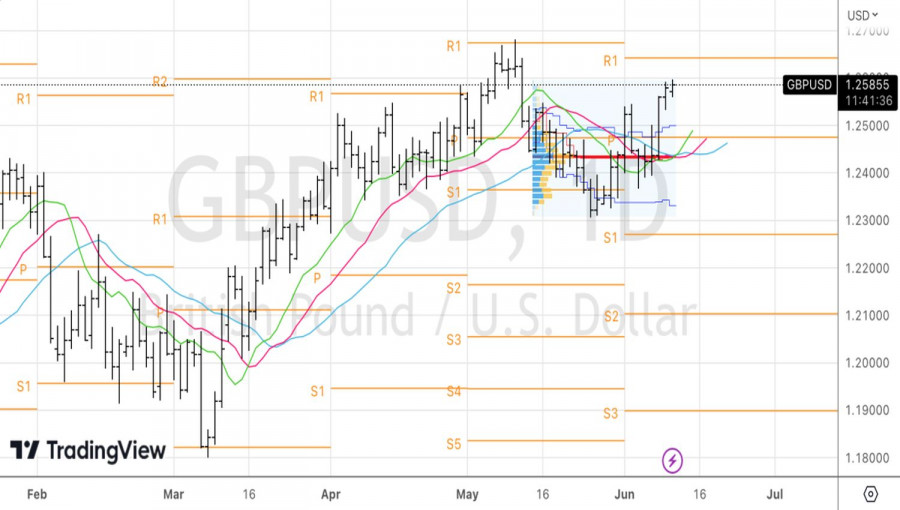

Technically, on the daily chart, the bulls intend to restore the upward trend. The presence of quotes above dynamic support in the form of moving averages indicates that buyers are in control of the market. However, the inability of GBP/USD to break above the 1.2645 pivot level or a drop below the support at 1.2565 will indicate weakness in the bulls and provide a basis for forming short positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The GBP/USD currency pair also traded higher on Friday. However, it's worth noting that the British currency—once praised for its remarkable resilience against the dollar in recent years—is now rising

On Thursday, investors realized there is currently no such thing as stability. High market volatility remains and will continue to dominate for some time. The ongoing cause of this remains

A relatively large number of macroeconomic events are scheduled for Friday, but none are expected to impact the market. Of course, we may see short-term reactions to individual reports

The GBP/USD currency pair also traded higher on Thursday. As a reminder, macroeconomic and traditional fundamental factors currently have little to no influence on currency movements. The only thing that

Ferrari F8 TRIBUTO

from InstaTrade

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.