See also

31.01.2025 01:43 PM

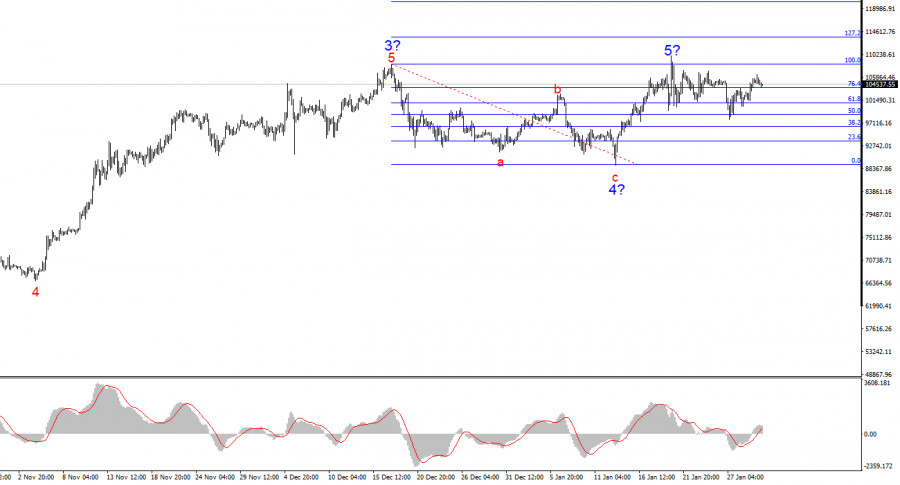

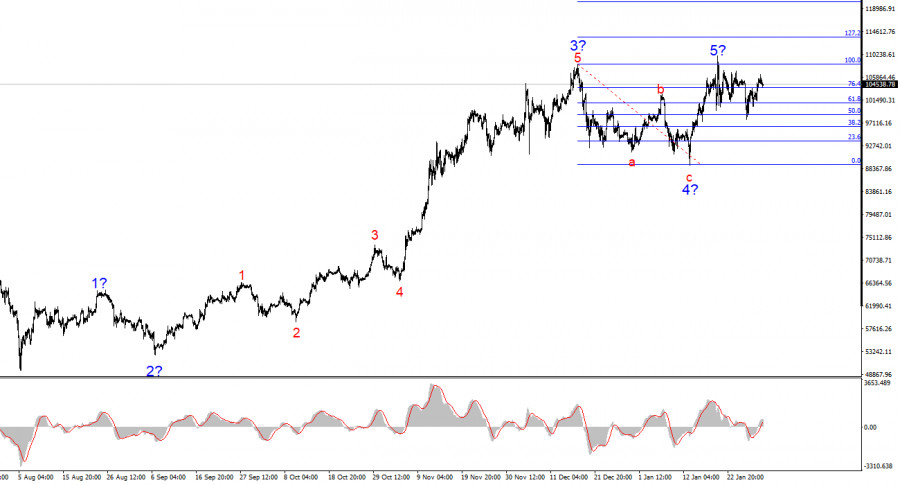

31.01.2025 01:43 PMThe wave structure on the 4-hour chart on the BTC/USD appears entirely clear. Following a prolonged and complex a-b-c-d-e corrective pattern that developed from March 14 to August 5, a new impulse wave has emerged, which has already taken on a five-wave structure. Given the size of the first wave within this structure, the fifth wave may end up being truncated. Based on this, I do not expect Bitcoin to rise above $110,000–$115,000 in the coming months.

Additionally, Wave 4 has taken on a three-wave structure, confirming the accuracy of the current wave count. Since the construction of the anticipated Wave 5 has begun, it makes sense to look for buying opportunities. However, as I mentioned earlier, this wave may conclude very soon (or may have already ended).

The news backdrop has supported Bitcoin's growth due to a steady flow of reports about new investments from institutional traders, governments of certain countries, and even pension funds. However, Trump's policies could drive investors out of the market, and the trend cannot remain upward indefinitely.

BTC/USD surged by $1,400 on Thursday. Buyers continue to hold Bitcoin near its historical highs, signaling to the market that the leading cryptocurrency could continue rising. However, in my view, caution is warranted when buying at current price levels.

Undoubtedly, if demand remains strong, Bitcoin could rise to $150,000 or even $200,000. However, anyone familiar with the cryptocurrency market knows that Bitcoin is not only famous for its explosive rallies but also for its frequent 80–90% crashes.

The crypto market is highly susceptible to manipulation by large players due to the lack of regulation from central banks or other authorities. Major Bitcoin holders can push the price up or down at will, with the ultimate target being profit maximization. At current prices, they could trigger a mass sell-off, only to start accumulating again around $50,000—or even lower.

That said, most market participants are not yet prepared for a crash. While Donald Trump has not yet begun filling the U.S. Treasury with Bitcoin, he has ordered an evaluation of this "business plan." Meanwhile, Jerome Powell also mentioned Bitcoin in his speech on Wednesday evening—a rare occurrence.

The Fed Chairman stated that the crypto market needs a regulatory framework and that banks should improve their risk management strategies regarding cryptocurrencies. These remarks indicate that the Fed supports the development of the crypto sector—and so does Donald Trump. Against this backdrop, Bitcoin demand remains consistently high.Based on my BTC/USD analysis, I conclude that the current uptrend is nearing its end. While this view may be unpopular, Wave 5 could end up being truncated, followed by a sharp decline or a complex correction. Therefore, I do not recommend buying Bitcoin at this time.

If Wave 5 develops into an extended five-wave structure, then a convincing corrective Wave 2 should form within it. At the moment, Wave 2 is visible on the chart, but it is not very strong. I believe that at least one more decline is likely.

On a higher time frame, a five-wave upward structure is clearly visible. This suggests that a corrective, downward structure or a bearish trend phase may soon begin.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin and Ethereum, having spent the entire weekend moving sideways within a range, surged sharply during today's Asian session. The rally was triggered by rumors that U.S. Federal Reserve Chair

Bitcoin and Ethereum remain within their sideways channels, and the inability to break out of these ranges could jeopardize the prospects for a broader recovery in the cryptocurrency market. However

After successfully exiting the Ascending Broadening Wedge pattern on the 4-hour chart of the Litecoin cryptocurrency followed by the appearance of Divergence between the Litecoin price movement and the Stochastic

Pressure on the cryptocurrency market returned yesterday after traders and investors triggered a sell-off in the U.S. stock market. As I've noted repeatedly, the correlation between these two markets

Over the past weekend, Bitcoin and Ethereum demonstrated decent resilience, maintaining a chance for further recovery. While from a technical standpoint, those chances may appear rather slim, trading within

Bitcoin and Ethereum dropped in value toward the end of Thursday's U.S. session but recovered during today's Asian trading hours. It has become common practice that the crypto market declined

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.