See also

06.03.2025 06:56 PM

06.03.2025 06:56 PMGold is attracting sellers today, yet it manages to hold above the $2,900 level.

Despite selling pressure, gold remains above $2,900 as market sentiment shifts toward riskier assets. The recent U.S. tariff concessions on Canada and Mexico have fueled risk appetite, leading to capital outflows from safe-haven assets such as gold. However, the intraday decline lacks strong fundamental backing, suggesting that losses may remain limited.

Investors remain concerned about President Donald Trump's tariff policies and the rising risk of a global trade war. These factors continue to support gold, which is traditionally seen as a safe-haven asset. Additionally, expectations that Trump's economic policies could slow U.S. growth, prompting the Federal Reserve to implement deeper rate cuts in 2025, are providing further support, preventing a steep gold selloff.

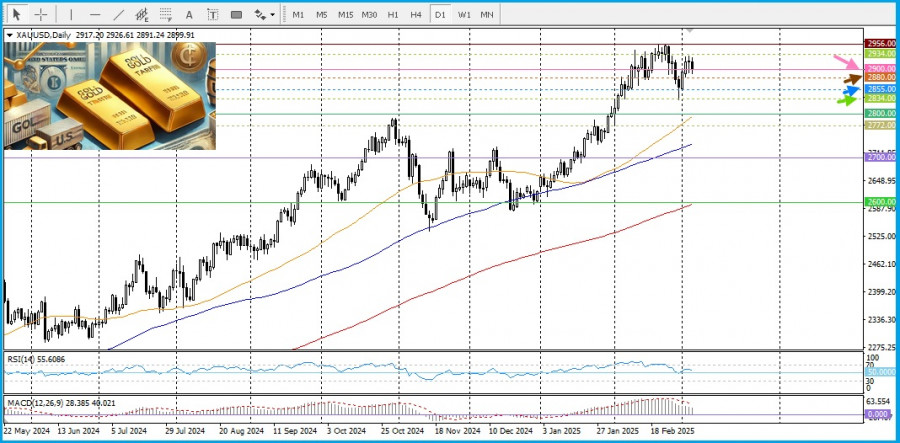

A break above the $2,934 level could push gold prices back toward the all-time high of $2,956, recorded in February. Such a move could act as a bullish trigger, reinforcing the long-term uptrend, which remains intact, supported by positive oscillators on the daily chart.

However, the lack of follow-through buying calls for caution before initiating new long positions. Any corrective pullback could be viewed as a buying opportunity near the key psychological level of $2,900. However, if selling pressure intensifies, a deeper decline could target intermediate support at $2,880, followed by the next downside level at $2,855.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 142.93 occurred when the MACD indicator had just started moving downward from the zero mark, confirming a valid entry point for selling the dollar

The test of the 1.3238 price level occurred when the MACD indicator had just begun rising from the zero line, which confirmed a valid entry point for buying the pound

The price test at 1.1311 occurred when the MACD indicator had just started to move downward from the zero level, confirming a valid entry point for selling the euro

Trade Review and Euro Trading Tips The test of the 1.1336 price level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the downward

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.