See also

On Wednesday, the EUR/USD currency pair failed to establish new grounds for its upward movement. This is not surprising, as the market has primarily been reacting to news related to Donald Trump—specifically, announcements about new tariffs. However, the market tends to ignore news regarding the delays or cancellations of these tariffs.

In practical terms, this dynamic plays out as follows: when Trump announces new import tariffs, the dollar tends to decline; conversely, when he postpones or cancels those tariffs, the dollar does not tend to recover. Therefore, we believe the current decline of the dollar is not entirely justified. The market seems to be overlooking essential fundamental and macroeconomic factors and is behaving as if the Federal Reserve has cut interest rates to zero and the U.S. economy is already in a recession.

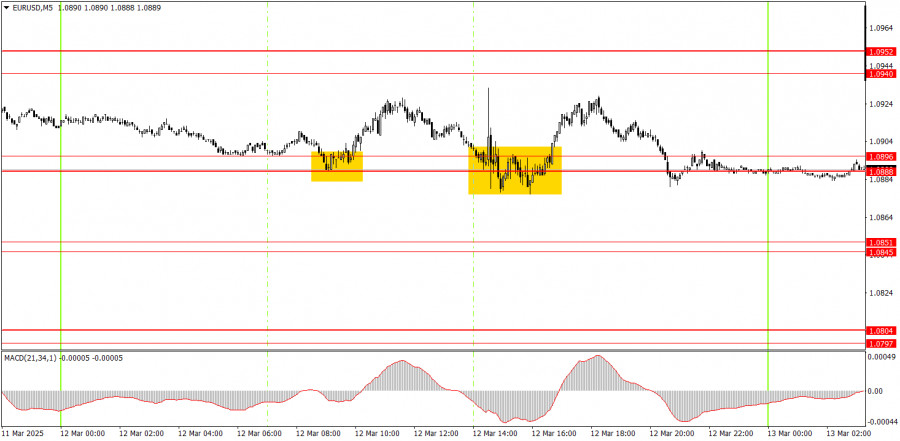

On the 5-minute timeframe on Wednesday, two trading signals emerged. First, the price bounced off the 1.0888-1.0896 range, moving up by only 20 pips, which was enough to adjust to a breakeven Stop Loss, leading to a trade closure. Then, there was another slight rebound from the same range, and once again, the price increased by 20 pips in the expected direction.

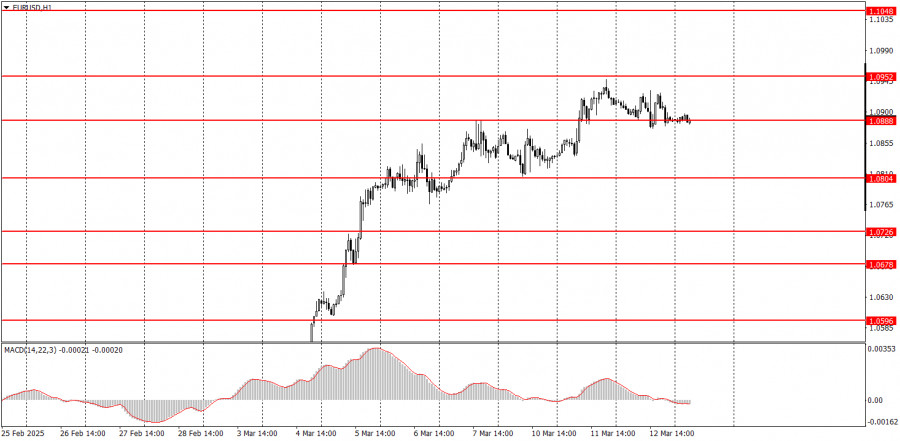

On the hourly timeframe, the EUR/USD pair remains in a medium-term downtrend, but the chances of its continuation are decreasing. Given that fundamental and macroeconomic factors continue to support the U.S. dollar more than the euro, we still expect a decline. However, Trump's regular decisions and statements keep pushing the dollar lower. Right now, political and geopolitical factors overshadow fundamental and macroeconomic data.

On Thursday, the euro may trade in either direction, as macroeconomic and fundamental factors currently have no consistent impact on price movement. The market essentially ignored yesterday's U.S. inflation report.

For the EUR/USD pair, relevant levels on the 5-minute timeframe are 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896, 1.0940-1.0952, 1.1011, and 1.1048. On Thursday, the macroeconomic background will have no impact. The market is ignoring much more important reports than industrial production in the Eurozone or the U.S. producer price index, which are secondary indicators.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.