See also

19.03.2025 12:46 AM

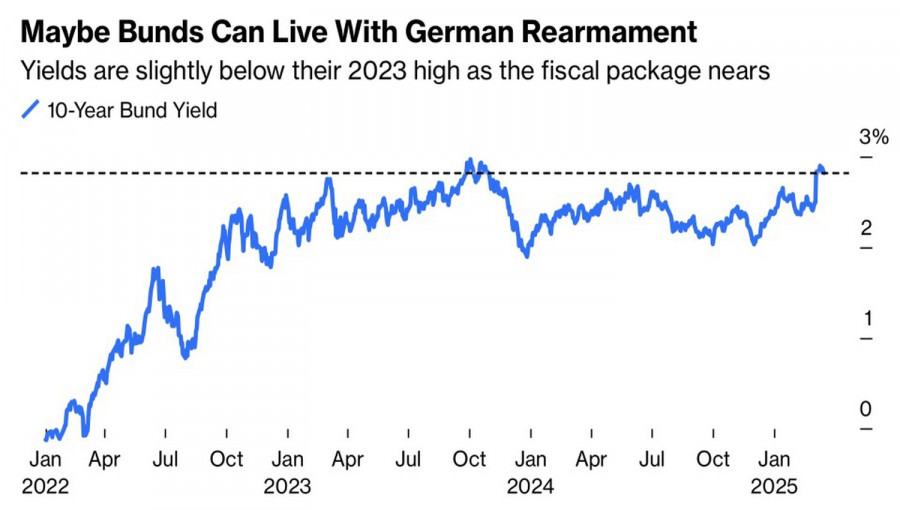

19.03.2025 12:46 AMThe last time Germany armed itself was in the 1930s, it led to World War II. Today, German militarization is welcomed. According to Bloomberg estimates, fiscal stimulus packages worth around $1 trillion will add one percentage point to GDP in the near term, bringing it to 2% by 2024. This will push bond yields higher, and the narrowing spread with U.S. Treasuries will create a strong foundation for a long-term uptrend in EUR/USD. Is it time to jump on the last northbound train?

Germany's shift from fiscal restraint to fiscal expansion is being compared to the Marshall Plan, which helped rebuild Europe after World War II. As the U.S. moves to curb government spending, this divergence in fiscal policy—which previously favored EUR/USD bears—now favors the euro. Instead of American exceptionalism, we now see German exceptionalism.

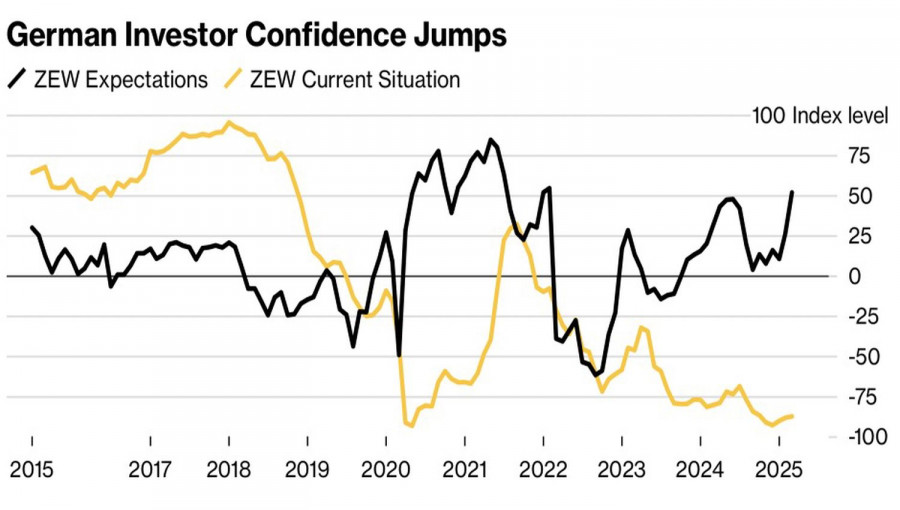

The currency pair broke through key resistance at 1.091 and climbed toward 1.095, fueled by growing confidence in German business. The ZEW economic expectations index surged to its highest level since February 2022, driven by hopes for large-scale stimulus packages from Friedrich Merz. The current conditions indicator also improved.

The euro's long-term outlook remains positive, but the EUR/USD rally may be limited in the short term for three reasons. First, the "Trump trade" has run its course. Second, the market is overestimating the risk of a U.S. recession. Third, expectations for aggressive Federal Reserve monetary easing are likely exaggerated.

The U.S. dollar index strengthened by 7% from its September lows thanks to the "Trump trade"—investors betting on U.S. economic acceleration and the Fed keeping rates high. However, by mid-March, EUR/USD had returned to its levels from the November elections, recovering most of its previous losses. It's time to reap the profits.

According to Treasury Secretary Scott Bessent, the U.S. economy is in good shape with no signs of an impending recession. Investors were spooked by Donald Trump's comments, where he did not rule out an economic slowdown or a series of disappointing data releases. However, other reports suggest that the economy remains stable. Renewed market optimism could drive renewed dollar buying alongside the gradual scaling back of expectations for Fed rate cuts. Markets anticipate a 70-basis-point cut by the end of 2025—likely too much.

On the daily EUR/USD chart, an "Anti-Turtles" pattern may be forming. A drop below support at 1.089 would be a signal to sell. However, buying strategies could regain momentum if the pair fails to reach that level or bounces back after testing it.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Several macroeconomic reports are scheduled for Thursday. Germany will release its industrial production report for September, while the Eurozone will publish retail sales data for September. It is important

The EUR/USD currency pair traded very weakly again on Wednesday, maintaining a downward inclination. The only significant events of the day included the ISM services activity index from the U.S

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.