See also

14.04.2025 08:12 AM

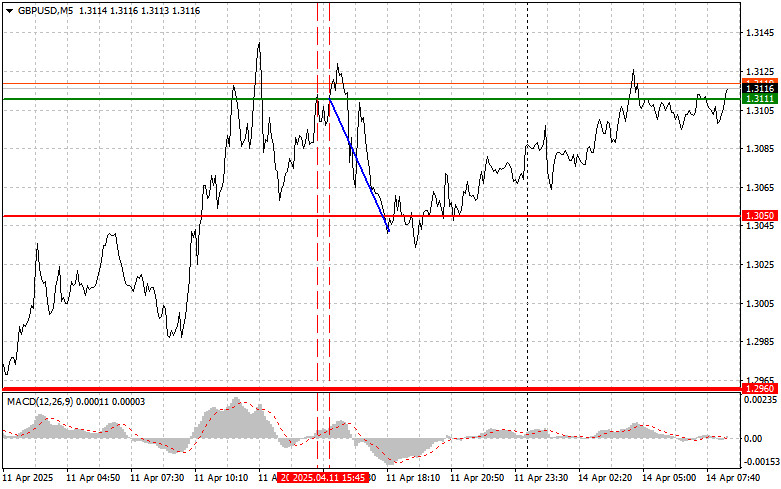

14.04.2025 08:12 AMThe price test at 1.3111 occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential at the end of the week. For this reason, I did not buy the pound. Shortly afterward, the second test of 1.3111 coincided with the MACD being in overbought territory, confirming a valid entry point for selling the pound, which led to a 60-pip decline in the pair.

Following the release of data showing a sharp drop in U.S. producer price inflation, the British pound strengthened, in line with the performance of other risk assets. However, by the end of the week, the pair failed to consolidate near weekly highs. The noticeable rise in the currency pair supported the bullish trend, which will likely continue developing over the current week. Previously published positive UK GDP data also provided support for the British currency.

The March U.S. PPI report was a welcome surprise for traders and the Federal Reserve. Instead of the forecasted increase, the index showed a significant decline, which put additional pressure on the dollar. This situation allows the Fed to ease monetary policy by lowering interest rates. Such measures would aim to stimulate economic growth, which is currently under threat due to trade conflicts initiated by the Trump administration.

Today, no UK economic data is scheduled, so GBP/USD buyers have every opportunity to maintain control of the market. However, volatility could drop sharply during the first half of the trading day.

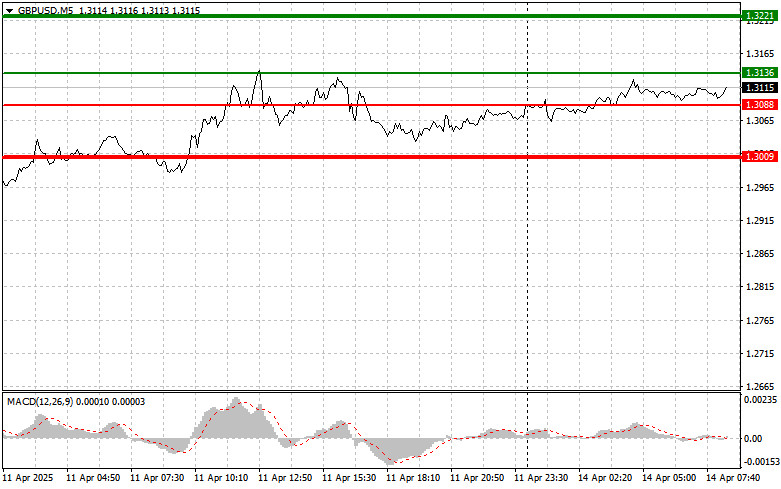

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.3136 (green line on the chart), targeting a rise to 1.3221 (thicker green line on the chart). Around 1.3221, I plan to exit long positions and open short positions in the opposite direction, anticipating a 30–35 pip pullback. Today's pound rally is expected to continue the current uptrend.

Important: Before buying, ensure that the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the pound if the price tests 1.3088 twice a row while the MACD is in oversold territory. This will likely limit the pair's downside potential and lead to an upward reversal. In this case, I expect a rise toward the opposite levels of 1.3136 and 1.3221.

Scenario #1: I plan to sell the pound after it breaks below 1.3088 (red line on the chart), which should trigger a sharp drop in the pair. The main target for sellers will be 1.3009, where I will exit short positions and immediately open long positions in the opposite direction, aiming for a 20–25 pip retracement. Be cautious with pound selling.

Important: Before selling, ensure the MACD indicator is below the zero line and starting to decline from it.

Scenario #2: I also plan to sell the pound if the price tests 1.3136 twice a row while the MACD is overbought territory. This will limit the pair's upside potential and lead to a reversal downward. In this case, expect a decline toward the opposite levels of 1.3088 and 1.3009.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test of 1.1521 in the second half of the day coincided with the beginning of a downward movement of the MACD indicator from the zero level, which confirmed

The price test at 142.20 occurred when the MACD indicator had already moved significantly below the zero line, limiting the pair's downside potential. For this reason, I didn't sell

The price test at 1.3268 occurred when the MACD indicator moved significantly above the zero line, limiting the pair's upside potential. For that reason, I did not buy the pound

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.