#AA (Alcoa Inc). Taux de change et graphiques en ligne.

Currency converter

28 Mar 2025 21:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Alcoa Inc. (Alcoa), incorporated in 1888, is engaged in the production and management of primary aluminum, fabricated aluminum, and alumina combined, through its participation in technology, mining, refining, smelting, fabricating, and recycling. Alcoa’s products are used worldwide in aircraft, automobiles, commercial transportation, packaging, building and construction, oil and gas, defense, consumer electronics, and industrial applications. Alcoa is a global company operating in 31 countries. Alcoa’s operations consist of four worldwide reportable segments: Alumina, Primary Metals, Flat-Rolled Products, and Engineered Products and Solutions. On March 9, 2011, Alcoa completed an acquisition of the aerospace fastener business of TransDigm Group Inc.

Alumina

The segment represents a portion of Alcoa’s upstream operations and consists of the Company’s worldwide refinery system, including the mining of bauxite, which is then refined into alumina. Alumina is mainly sold directly to internal and external smelter customers worldwide or is sold to customers who process it into industrial chemical products. A portion of the segment’s third-party sales are completed through the use of agents, alumina traders, and distributors. Slightly more than half of Alcoa’s alumina production is sold under supply contracts to third parties worldwide, while the remainder is used internally by the Primary Metals segment.

Primary Metals

The segment represents a portion of Alcoa’s upstream operations and consists of the Company’s worldwide smelter system. Primary Metals receives alumina, mostly from the Alumina segment, and produces primary aluminum used by Alcoa’s fabricating businesses, as well as sold to external customers, aluminum traders, and commodity markets. Results from the sale of aluminum powder, scrap, and excess power are also included in this segment, as well as the results of aluminum derivative contracts and buy/resell activity. The sale of primary aluminum represents more than 90% of this segment’s third-party sales. At December 31, 2011, Alcoa had 644 kilo-metric tons of idle capacity on a base capacity of 4,518 kilo-metric tons.

Flat-Rolled Products

The segment represents Alcoa’s midstream operations, whose principal business is the production and sale of aluminum plate and sheet. A small portion of this segment’s operations relate to foil produced at one plant in Brazil. The segment includes rigid container sheet (RCS), which is sold directly to customers in the packaging and consumer market and is used to produce aluminum beverage cans. The segment also includes sheet and plate used in the aerospace, automotive, commercial transportation, and building and construction markets (mainly used in the production of machinery and equipment and consumer durables), which is sold directly to customers and through distributors. Approximately one-half of the third-party sales in this segment consist of RCS, while the other one-half of third-party sales are derived from sheet and plate and foil used in industrial markets.

Engineered Products and Solutions

The segment represents Alcoa’s downstream operations and includes titanium, aluminum, and super alloy investment castings; forgings and fasteners; aluminum wheels; integrated aluminum structural systems; and architectural extrusions used in the aerospace, automotive, building and construction, commercial transportation, and power generation markets. The products are sold directly to customers and through distributors. Additionally, hard alloy extrusions products, which are also sold directly to customers and through distributors, serve the aerospace, automotive, commercial transportation, and industrial products markets. Engineered Products and Solutions business is a global designer, producer, and supplier of engineered aircraft components, with three locations (one in the state of California and two in the United Kingdom). Specifically, this business provides a variety of nickel alloy specialty engine fasteners, airframe bolts, and slotted entry bearings.

See Also

- Technical analysis

Signaux de Trading pour l'OR (XAU/USD) du 28 au 31 mars 2025 : vendre en dessous de 3 078 $ (correction technique - 21 SMA)

Un support important se situe autour de la 21 SMA à 3,035. Ce niveau coïncide avec le bas du canal haussier, ce qui pourrait suggérer un rebond technique dans les jours à venir.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

1048

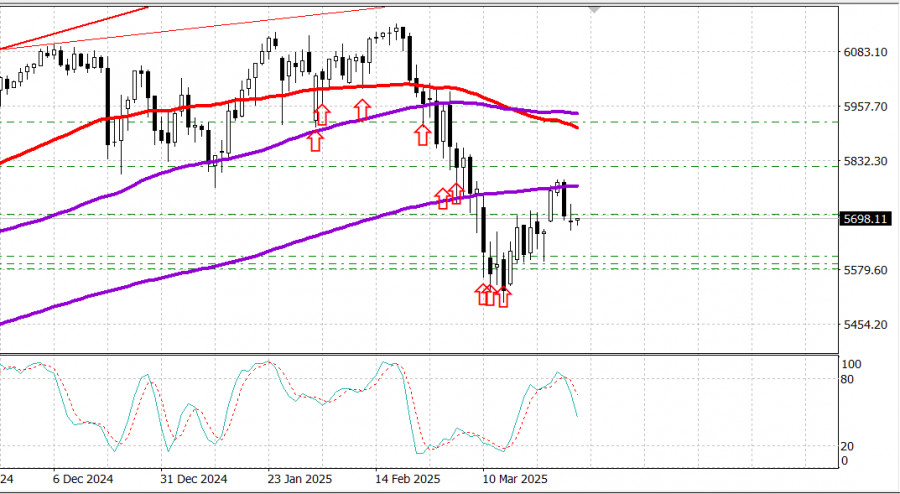

Les investisseurs optimistes ont été à l'attaque pendant deux semaines, mais ils sont à bout de souffle.Author: Samir Klishi

11:48 2025-03-28 UTC+2

1048

Le AUD/USD prolonge sa fourchette autour de 0,6300 avant l'indice des prix PCE des États-Unis.Author: Irina Yanina

12:16 2025-03-28 UTC+2

1048

- Fundamental analysis

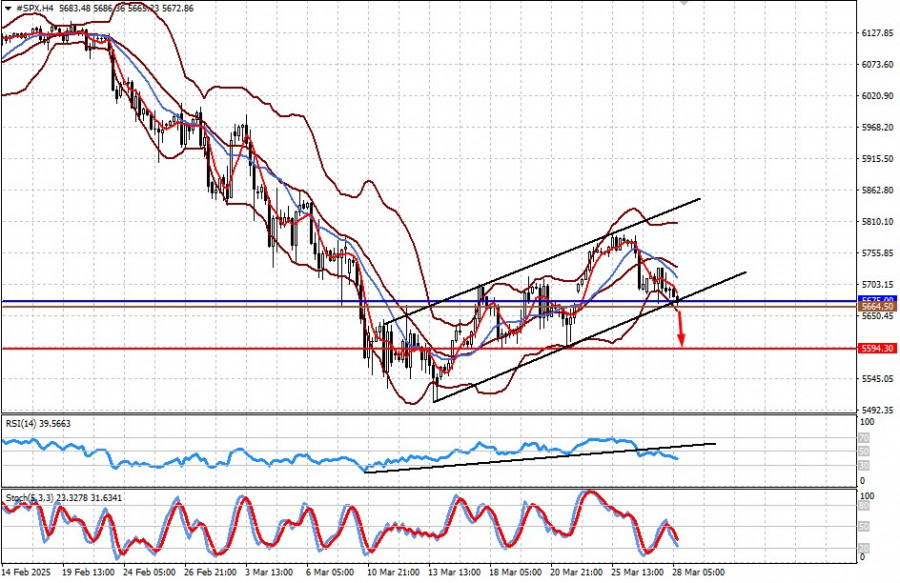

Les marchés à la croisée des chemins avant l'annonce des tarifs par D. Trump (possible baisse des contrats CFD sur les futures #SPX et #NDX)

Les marchés à la croisée des chemins avant l'annonce des tarifs par D. Trump (baisse possible des contrats CFD sur les futures #SPX et #NDX).Author: Pati Gani

11:39 2025-03-28 UTC+2

1018

Les actions du secteur automobile chutent après la mise en place de tarifs douaniers par Trump. Les titres de Advanced Micro Devices reculent. Les demandes d'allocations chômage augmentent à 224 000. Le dollar se renforce par rapport au dollar canadien et au peso mexicain. S&P 500 -0,33 %,.Author: Gleb Frank

12:46 2025-03-28 UTC+2

1003

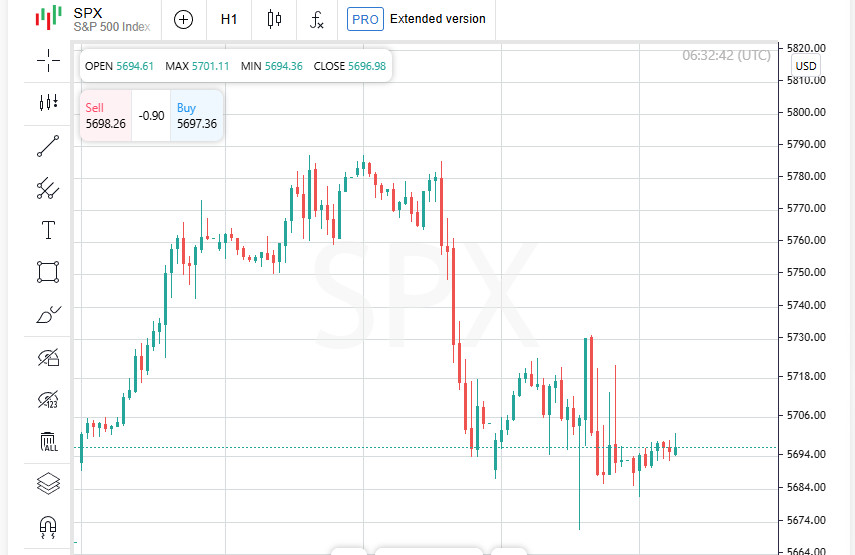

Bourse le 28 mars : S&P 500 et NASDAQ en position difficile.Author: Jakub Novak

11:29 2025-03-28 UTC+2

988

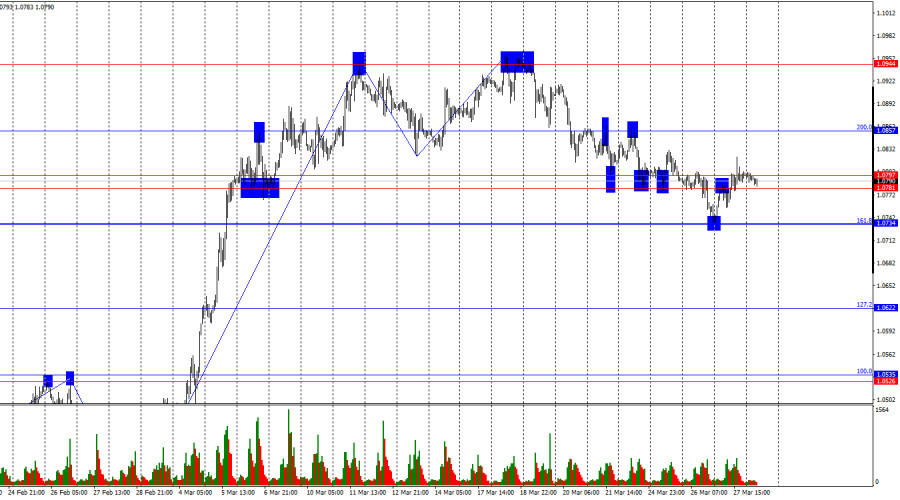

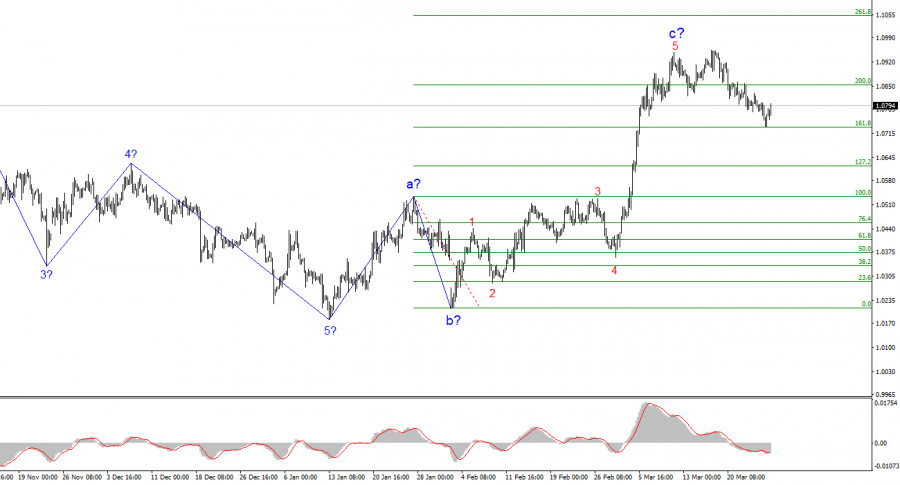

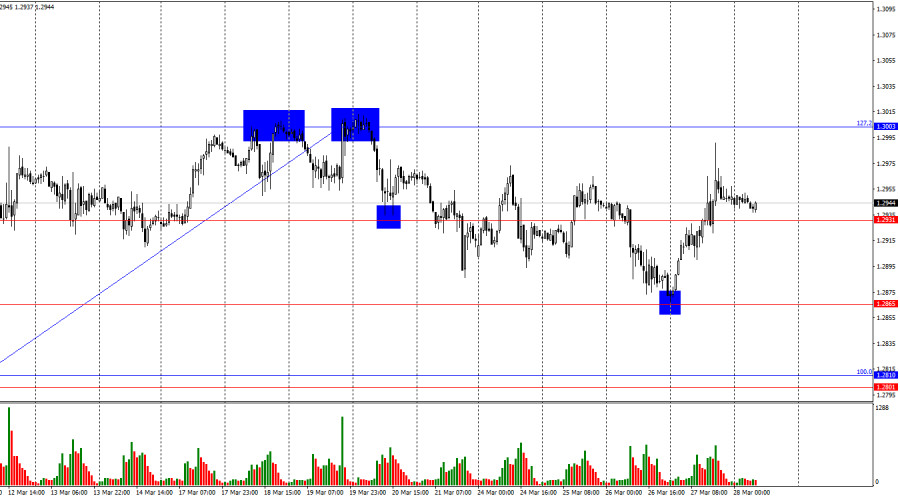

- La paire EUR/USD a augmenté de 60 points de base au cours de la journée de jeudi.

Author: Chin Zhao

20:10 2025-03-28 UTC+2

988

Stock MarketsMarché boursier américain : Les tarifs de Trump freinent la tendance haussière, donc les indices boursiers de référence se consolident. Les données PCE sont sur le radar des investisseurs aujourd'hui.

Marché boursier américain : les droits de douane de Trump interrompent la tendance haussière, les indices boursiers de référence se consolident. Les données du PCE sont aujourd’hui sous le radar des investisseurs.Author: Jozef Kovach

09:46 2025-03-28 UTC+2

988

Les ours essaient de percer les défenses des taureaux.Author: Samir Klishi

11:36 2025-03-28 UTC+2

973

- Technical analysis

Signaux de Trading pour l'OR (XAU/USD) du 28 au 31 mars 2025 : vendre en dessous de 3 078 $ (correction technique - 21 SMA)

Un support important se situe autour de la 21 SMA à 3,035. Ce niveau coïncide avec le bas du canal haussier, ce qui pourrait suggérer un rebond technique dans les jours à venir.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

1048

- Les investisseurs optimistes ont été à l'attaque pendant deux semaines, mais ils sont à bout de souffle.

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1048

- Le AUD/USD prolonge sa fourchette autour de 0,6300 avant l'indice des prix PCE des États-Unis.

Author: Irina Yanina

12:16 2025-03-28 UTC+2

1048

- Fundamental analysis

Les marchés à la croisée des chemins avant l'annonce des tarifs par D. Trump (possible baisse des contrats CFD sur les futures #SPX et #NDX)

Les marchés à la croisée des chemins avant l'annonce des tarifs par D. Trump (baisse possible des contrats CFD sur les futures #SPX et #NDX).Author: Pati Gani

11:39 2025-03-28 UTC+2

1018

- Les actions du secteur automobile chutent après la mise en place de tarifs douaniers par Trump. Les titres de Advanced Micro Devices reculent. Les demandes d'allocations chômage augmentent à 224 000. Le dollar se renforce par rapport au dollar canadien et au peso mexicain. S&P 500 -0,33 %,.

Author: Gleb Frank

12:46 2025-03-28 UTC+2

1003

- Bourse le 28 mars : S&P 500 et NASDAQ en position difficile.

Author: Jakub Novak

11:29 2025-03-28 UTC+2

988

- La paire EUR/USD a augmenté de 60 points de base au cours de la journée de jeudi.

Author: Chin Zhao

20:10 2025-03-28 UTC+2

988

- Stock Markets

Marché boursier américain : Les tarifs de Trump freinent la tendance haussière, donc les indices boursiers de référence se consolident. Les données PCE sont sur le radar des investisseurs aujourd'hui.

Marché boursier américain : les droits de douane de Trump interrompent la tendance haussière, les indices boursiers de référence se consolident. Les données du PCE sont aujourd’hui sous le radar des investisseurs.Author: Jozef Kovach

09:46 2025-03-28 UTC+2

988

- Les ours essaient de percer les défenses des taureaux.

Author: Samir Klishi

11:36 2025-03-28 UTC+2

973