#PLF (Platinum, Current Month). Exchange rate and online charts.

Currency converter

26 Mar 2025 23:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Platinum was known to people in the first half of 18th century, and the first reference to it dates back to the 16th century in the writings of Italian physician, scholar, and poet Julius Caesar Scaliger. The metal had been called platina ("little silver").

During the 19th century, platinum was very difficult to metalsmith. It was often mixed with iridium in order to mold it into jewelry. Around the turn of the 20th century, Russia made several significant platinum deposit discoveries and began to produce 90% of the world's platinum. At the same time, advances in metalsmithing made the use of pure platinum more common.

Today, supplies of platinum are concentrated in South Africa, which accounts for approximately 80% of supply; Russia, 11%; and North America, 6%.

Platinum's metallic properties make it highly attractive in a variety of commercial and industrial applications. Jewelry creates the largest demand for platinum (51%), followed by automotive’s 29% used in catalytic converters for the reduction of CO emissions in the exhaust gases from motor vehicles. 13% go to chemical and petroleum refining uses. In addition, 7% of platinum goes to high-tech industries, including personal computers and consumer electronics.

Because of platinum’s importance as an industrial material, its relatively low production and concentration among a few suppliers, prices can be volatile. For this reason, platinum is often considered attractive to investors.

Platinum futures are traded on the New York Mercantile Exchange under ticker symbol PL in U.S. dollars and cents in lot sizes of 50 troy ounces. Minimum price fluctuation is $0.10 per troy ounce.

Trading hours on the CME Globex electronic platform: 6:00 PM until 5:15 PM Sunday through Friday. There is a 45-minute break each day between 5:15PM (current trade date) and 6:00 PM (next trade date), New York Time. Open Outcry: 8:20 AM to 1:05 PM, New York Time. Trading terminates on the third last business day of the delivery month.

Platinum futures are delivered every year in January, February, March, April, May, June, July, August, September, October, November and December (all months). Delivery months’ codes are: F=Jan, G=Feb, H=Mar, J=Apr, K=May, M=June, N=July, Q=Aug, U=Sep, V=Oct, X=Nov, Z=Dec.

See Also

- Gold maintains a positive tone today, but lacks strong bullish momentum

Author: Irina Yanina

11:54 2025-03-26 UTC+2

1483

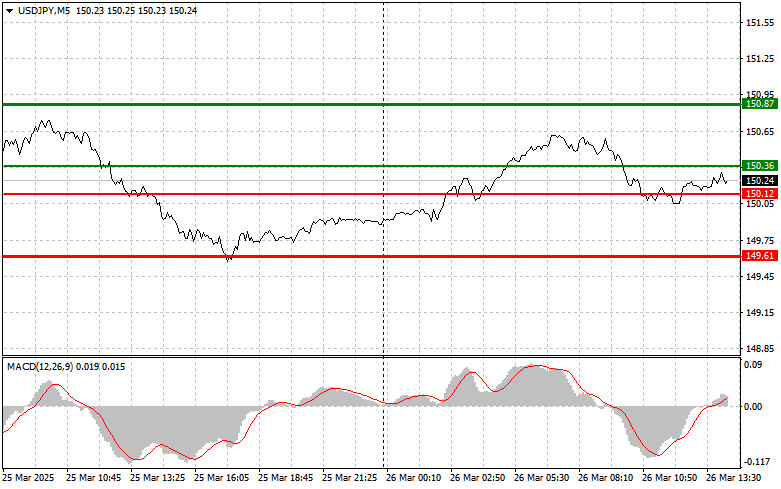

USD/JPY. Analysis and ForecastAuthor: Irina Yanina

11:42 2025-03-26 UTC+2

1468

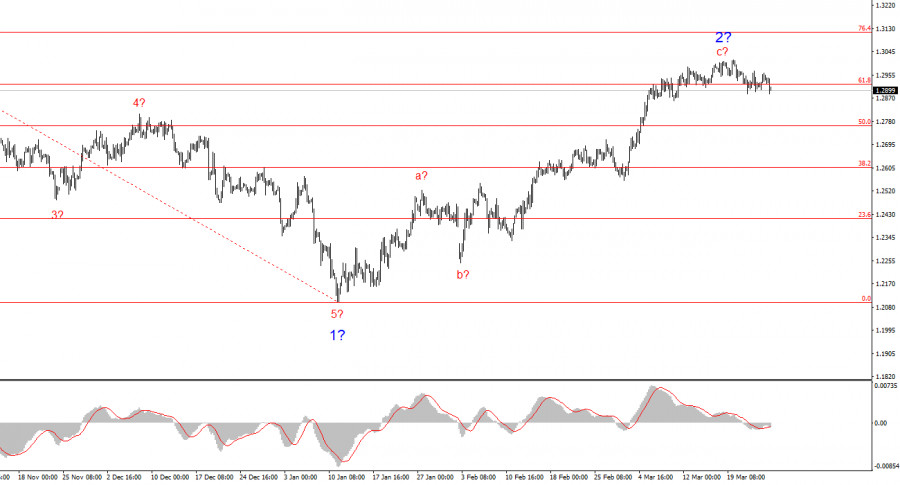

Bulls pushed for two weeks, but now it's time for a pauseAuthor: Samir Klishi

11:32 2025-03-26 UTC+2

1423

- USD/JPY: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:35 2025-03-26 UTC+2

1198

GBP/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)Author: Jakub Novak

18:29 2025-03-26 UTC+2

1138

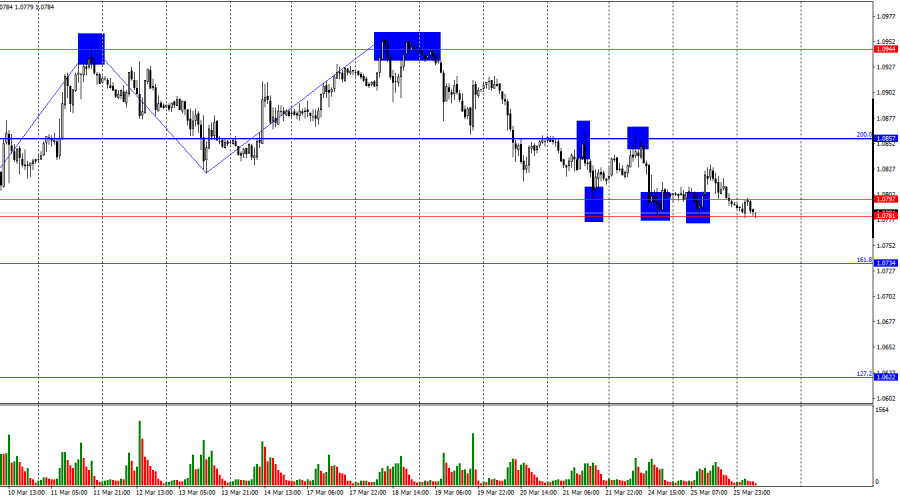

The GBP/USD rate declined by 55 basis points on Wednesday, marking the largest drop of the current week.Author: Chin Zhao

18:37 2025-03-26 UTC+2

1123

- Top banks are split on the S&P 500 outlook: the market remains in a zone of uncertainty. The S&P 500 is holding above a key level, but the rally lacks conviction

Author: Irina Maksimova

11:47 2025-03-26 UTC+2

1123

Technical analysisTrading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968, and eventually reach the 200 EMA around 2,939.Author: Dimitrios Zappas

16:11 2025-03-26 UTC+2

1123

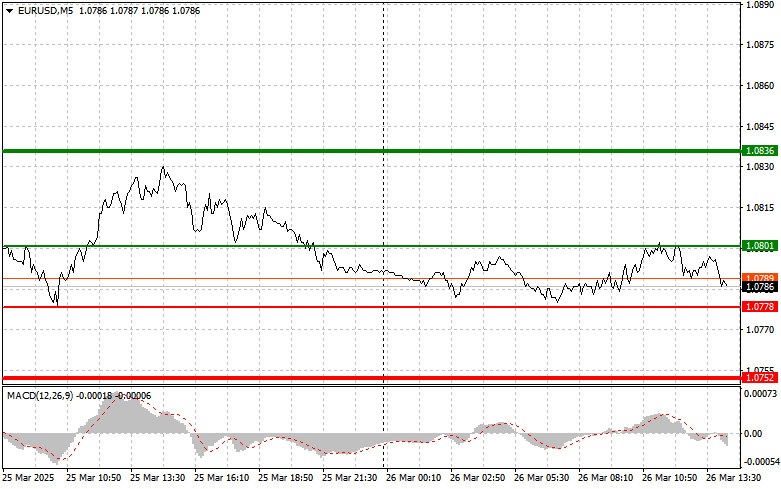

EUR/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)Author: Jakub Novak

18:27 2025-03-26 UTC+2

1063

- Gold maintains a positive tone today, but lacks strong bullish momentum

Author: Irina Yanina

11:54 2025-03-26 UTC+2

1483

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

11:42 2025-03-26 UTC+2

1468

- Bulls pushed for two weeks, but now it's time for a pause

Author: Samir Klishi

11:32 2025-03-26 UTC+2

1423

- USD/JPY: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:35 2025-03-26 UTC+2

1198

- GBP/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:29 2025-03-26 UTC+2

1138

- The GBP/USD rate declined by 55 basis points on Wednesday, marking the largest drop of the current week.

Author: Chin Zhao

18:37 2025-03-26 UTC+2

1123

- Top banks are split on the S&P 500 outlook: the market remains in a zone of uncertainty. The S&P 500 is holding above a key level, but the rally lacks conviction

Author: Irina Maksimova

11:47 2025-03-26 UTC+2

1123

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968, and eventually reach the 200 EMA around 2,939.Author: Dimitrios Zappas

16:11 2025-03-26 UTC+2

1123

- EUR/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:27 2025-03-26 UTC+2

1063