Lihat juga

27.07.2022 03:23 PM

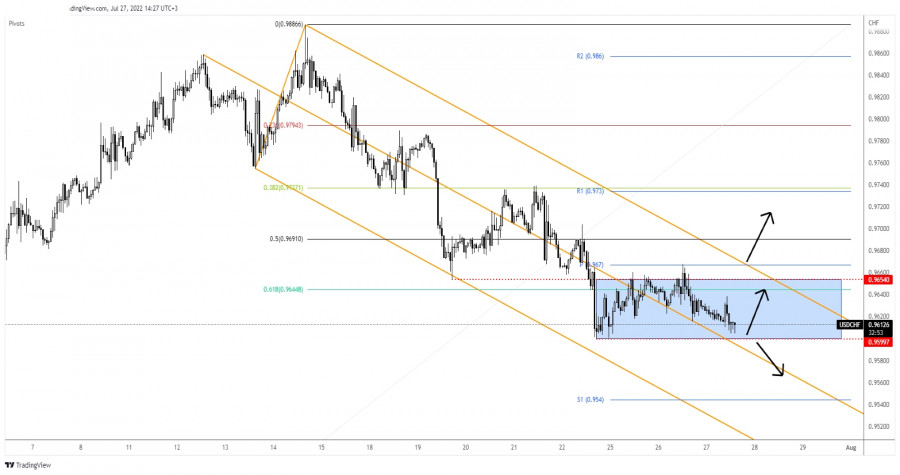

27.07.2022 03:23 PMThe USD/CHF pair is moving sideways in the short term, that's why we need to wait for the price to escape from this pattern before taking action. It was trading at 0.9623 at the time of writing. The pair has changed little lately and most likely the traders are expecting the FOMC decision before taking action. A 75bps rate hike is expected today. The Federal Funds Rate could be increased from 1.75% to 2.50%. The volatility could be huge around this event.

Technically, the USD/CHF pair was in a corrective phase in the short term but the price signaled that the sellers are exhausted and that the pair could try to develop a new leg higher. Fundamentally, the US data came in mixed today. Durable Goods Orders rose by 1.9% versus a 0.5% drop expected, Core Durable Goods Orders surged by 0.3% compared to 0.2% growth estimated, while the Goods Trade Balance Came in better than expected as well. Unfortunately for the USD, the Prelim Wholesale Inventories came in worse than expected. Later, the Pending Home Sales could bring more action.

In the short term, the USD/CHF pair is trapped between 0.9654 and 0.9599 levels. Jumping and the median line of the descending pitchfork, testing and retesting it signaled that the downside movement could be over.

Still, it's premature to talk about a new leg higher. The fundamentals will drive the rate today, so anything could happen. The bias remains bearish as long as it stays under the pitchfork's upper median line and below the weekly pivot point of (0.9670).

False breakdowns below 0.9599 could signal a new bullish momentum at least towards 0.9654 and up to the pitchfork's upper median line. A valid breakout above the upper median line (uml) and above the weekly pivot point of 0.9670 could activate a new swing higher and could bring new long signals, and setups.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga di 14068 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar

Uji level harga 1.3356 bertepatan dengan saat indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang tepat untuk menjual pound. Akibatnya, pasangan ini turun lebih

Uji level harga 1,1460 pada paruh kedua hari itu bertepatan dengan indikator MACD yang mulai bergerak turun dari garis nol, mengonfirmasi titik entri yang tepat untuk menjual euro. Akibatnya, pasangan

Euro dan pound merosot tajam, bersama dengan beberapa aset sensitif risiko lainnya yang dipasangkan dengan dolar AS—dan ada alasan objektif untuk ini. Kemarin, Donald Trump menyatakan kesiapannya untuk menurunkan tarif

Minyak dan gas terus bermain sesuai aturan politik besar. Setiap pernyataan Trump, setiap keputusan Federal Reserve, dan setiap langkah baru dari Tiongkok seperti kartu baru dalam permainan energi yang kompleks

Analisis Trading dan Tips Trading untuk Yen Jepang Uji pertama level 140.35 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli

Analisis dan Kiat-kiat Trading untuk Pound Inggris Uji level 1,3394 terjadi tepat saat indikator MACD mulai bergerak turun dari garis nol, mengonfirmasi titik masuk pasar yang valid. Akibatnya, pasangan

Rincian Trading dan Kiat-kiat untuk Trading Euro Pengujian level 1,1521 terjadi ketika indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang valid untuk posisi jual

Tidak ada pengujian pada level yang telah saya tandai di paruh kedua hari itu, karena volatilitas yen menurun secara signifikan. Data hari ini menunjukkan bahwa indeks harga konsumen inti Bank

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.