Lihat juga

03.04.2025 07:26 AM

03.04.2025 07:26 AMOn Wednesday, the GBP/USD pair surged by 160 pips and continues its rapid upward movement. Let us reiterate: we did not expect Donald Trump to impose tariffs on all countries globally, mainly with rates for selected nations ranging from 20% to 100%. Frankly, very few anticipated such harsh measures. No one in the world can predict Trump's actions. Accordingly, no one can forecast how the market will respond to any specific Trump decision, as those decisions are inherently unpredictable. Traders should now brace for prolonged negotiations between the U.S. and the countries buried in tariffs. Strong nations will retaliate; weaker ones will seek compromise. Global trade architecture will begin to shift—trade alliances will be formed, countermeasures will be introduced, and counter-countermeasures will follow. At this point, macroeconomic and fundamental factors are irrelevant.

On the 5-minute timeframe Wednesday, a buy signal formed during the European session, but its quality and accuracy left much to be desired. It's important to remember that the British pound had been trading in a tight flat for nearly a month, so strong signals were nothing but wishful thinking during that time. And on Wednesday morning, the flat range was still intact. During the day, the pair rose to the 1.2860 level, which was previously considered the upper boundary of the sideways channel. Then, after Trump published the list of countries subject to trade tariffs, the market experienced sharp movements. It would be easier to list the countries that didn't make it onto that list.

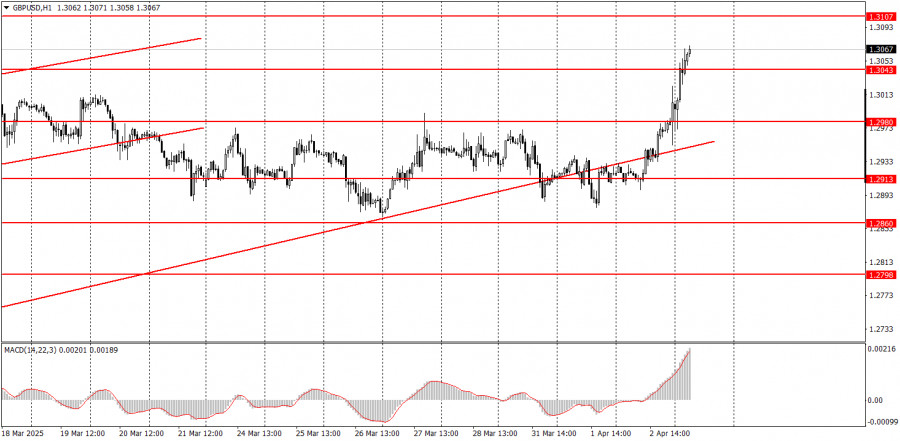

On the hourly timeframe, GBP/USD should have long since entered a downward trend, but Trump continues to do everything in his power to prevent that from happening. Now that the global trade war has officially begun, we will not attempt to predict long-term movements of currency pairs. It is best to trade using lower timeframes, where trends and reversals can be tracked more quickly. However, we caution traders that the currency market is now at the mercy of politics. Retaliatory measures against the U.S. could trigger significant market moves.

On Thursday, the GBP/USD pair will likely continue to rise. What else can be expected from the U.S. dollar now except further decline? We had assumed that the market had already priced in all of Trump's tariffs and had lost interest in the topic, but the American president once again managed to shock the markets—and this clearly won't be the last time.

On the 5-minute timeframe, you can currently trade using the following levels: 1.2301, 1.2372–1.2387, 1.2445, 1.2502–1.2508, 1.2547, 1.2613, 1.2680–1.2685, 1.2723, 1.2791–1.2798, 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107.

Business activity indices are scheduled for release in the UK and the U.S. on Thursday, but they will be irrelevant to traders who are still quietly horrified by recent developments.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Dalam prediksi pagi saya, saya menyoroti level 1,3247 sebagai titik acuan untuk keputusan memasuki pasar. Mari kita lihat grafik 5 menit dan menganalisis apa yang terjadi. Pasangan mata uang memang

Dalam prediksi pagi, saya menyoroti level 1,1341 sebagai titik kunci untuk keputusan masuk pasar. Mari perhatikan grafik 5 menit dan analisis apa yang terjadi di sana. Penurunan diikuti oleh false

Sepanjang hari Selasa, pasangan GBP/USD terus bergerak naik. Seperti yang kita lihat, mata uang Inggris tidak memerlukan alasan khusus untuk terus naik. Kami telah beberapa kali mengatakan bahwa saat

Pada hari Selasa, pasangan mata uang EUR/USD mengalami sedikit penurunan, yang dapat dianggap sebagai koreksi teknis murni. Kemarin — dan secara umum — dolar masih belum memiliki alasan nyata untuk

Pada hari Selasa, pasangan mata uang GBP/USD melanjutkan pergerakan naiknya hampir sepanjang hari. Tidak ada alasan signifikan atau dasar fundamental untuk ini, tetapi seluruh pasar mata uang bergerak secara acak

Pada hari Selasa, pasangan mata uang EUR/USD memulai penurunan yang telah lama dinantikan, meskipun tidak jatuh terlalu jauh atau terlalu lama. Perlu diingat bahwa tidak ada alasan fundamental untuk pertumbuhan

Dalam perkiraan pagi saya, saya fokus pada level 1.3204 dan merencanakan untuk membuat keputusan trading dari level tersebut. Mari kita lihat grafik 5 menit dan lihat apa yang terjadi. Terjadi

Dalam prediksi pagi, saya menyoroti level 1,1377 dan merencanakan untuk membuat keputusan trading dari sana. Mari perhatikan grafik 5 menit dan analisis apa yang terjadi. Kenaikan diikuti oleh false breakout

Pada hari Senin, pasangan GBP/USD melanjutkan pergerakan naiknya tanpa kesulitan. Tidak ada alasan makroekonomi untuk ini, dan bahkan euro menunjukkan pergerakan yang jauh lebih tenang pada akhir hari. Namun, pound

Pada hari Senin, pasangan mata uang EUR/USD lebih banyak diperdagangkan secara mendatar daripada naik, meskipun pada akhirnya tetap mengalami kenaikan nilai. Tidak ada peristiwa makroekonomi atau fundamental besar yang dijadwalkan

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.