Lihat juga

04.04.2025 09:03 AM

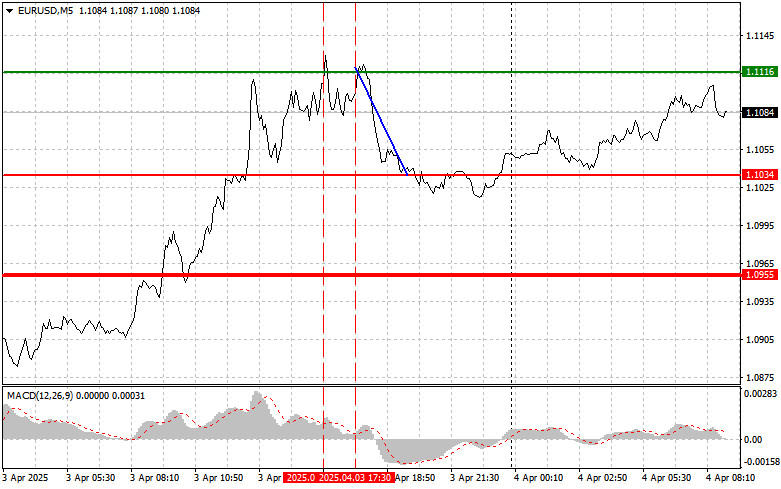

04.04.2025 09:03 AMThe price test at 1.1116 occurred when the MACD indicator moved significantly above the zero line, limiting the pair's upside potential. For this reason, I did not buy the euro. The second test of 1.1116 coincided with the MACD being in the overbought zone, which confirmed a valid entry point for a sell trade according to Scenario #2 and resulted in an 80-pip drop in the pair.

Yesterday was marked by a significant strengthening of the euro, driven by broad weakness in the U.S. dollar. This was triggered by the Trump administration's introduction of trade tariffs, which caused concern among market participants. Traders and investors lowered their forecasts for the U.S. economy, which led to a weaker dollar. Another factor that added to worries about slowing economic growth in the U.S. was the disappointing performance of the services sector. The corresponding index barely slipped below the critical 50-point mark, which would indicate stagnation in that sector.

Several economic reports will be released this morning, including data on German factory orders, Italian industrial production, and retail sales. If these data are positive, the euro will likely continue strengthening against the U.S. dollar. However, it's important to remember that other factors can also impact the currency market's dynamics. For instance, political risks in Europe or unexpected comments from European Central Bank officials could interrupt the upward trend.

Strong economic indicators from Germany and Italy will support the euro, but let's not forget that the U.S. labor market reports are ahead and will be the main focus in the second half of the day.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

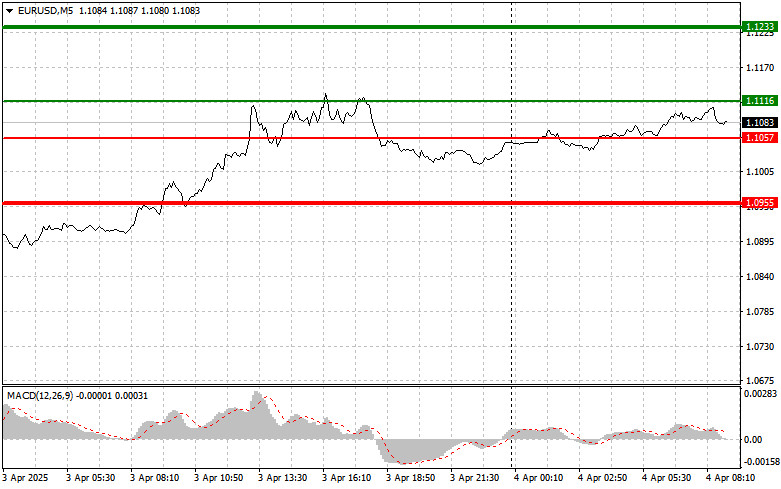

Scenario #1: I plan to buy the euro today if the price reaches around 1.1116 (green line on the chart) with a target of 1.1233. At 1.1233, I plan to exit the long position and open a sell trade in the opposite direction, aiming for a 30–35-pip move from the entry. A continuation of yesterday's upward trend can be expected in the first half of the day. Important! Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1057 level when the MACD indicator is in the oversold zone. This would limit the downside potential and lead to an upward market reversal. A rise toward the opposite levels of 1.1116 and 1.1233 can be expected.

Scenario #1: I plan to sell the euro after the price reaches 1.1057 (red line on the chart). The target will be 1.0955, where I plan to exit the short position and immediately buy in the opposite direction, aiming for a 20–25-pip move. Downward pressure on the pair is unlikely to return today. Important! Before selling, make sure the MACD indicator is below the zero line and beginning to decline.

Scenario #2: I also plan to sell the euro today in the case of two consecutive tests of the 1.1116 level when the MACD indicator is in the overbought zone. This would limit the pair's upside potential and lead to a reversal downward. A decline toward the opposite levels of 1.1057 and 1.0955 can be expected.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Uji level 142,32 terjadi ketika indikator MACD sudah bergerak jauh di atas level nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Karena alasan ini, saya tidak membeli dolar

Pengujian harga pada 1,1382 di paruh kedua hari ini bertepatan dengan dimulainya pergerakan turun indikator MACD dari garis nol, mengonfirmasi titik masuk yang tepat untuk menjual euro. Akibatnya, pasangan

Uji harga di 1.3285 terjadi ketika indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang valid untuk menjual pound. Akibatnya, pasangan ini turun lebih dari

Ulasan dan Saran Trading USD/JPY Tidak ada pengujian terhadap level yang saya tandai di paruh pertama hari ini. Pada paruh kedua hari ini, investor dan trader akan fokus pada indikator

Analisis Trading dan Saran Trading untuk Pound Inggris Pengujian level 1,3325 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi entri pasar yang benar. Namun, seperti yang

Analisis Trading dan Tips untuk Trading Euro Uji level harga 1.1405 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang valid untuk membeli euro

Pengujian harga di 14068 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar

Uji level harga 1.3356 bertepatan dengan saat indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang tepat untuk menjual pound. Akibatnya, pasangan ini turun lebih

Akun PAMM

InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.