Lihat juga

18.06.2024 12:44 AM

18.06.2024 12:44 AMThe Bank of England will hold its monetary policy meeting on June 20, and the rate is expected to remain at the level of 5.25%. This meeting will not be accompanied by updated forecasts, so the market may show a somewhat muted reaction.

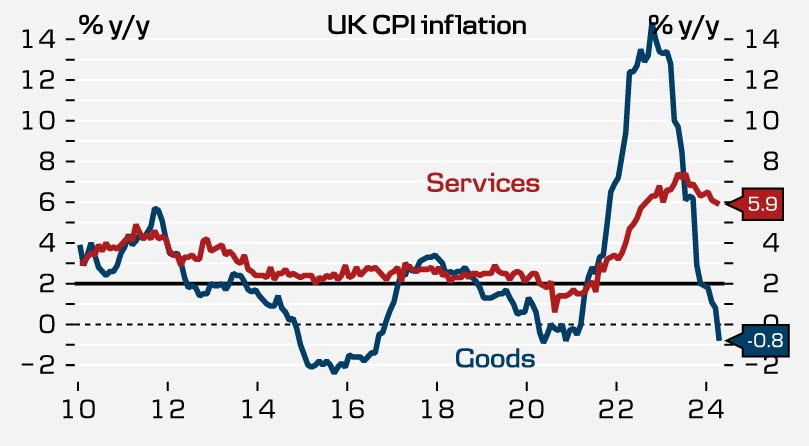

Since the previous BoE meeting, macroeconomic indicators have generally been slightly better than expected – GDP growth in Q1 increased by 0.6% against a forecast of 0.4%, and wage growth remained high, aided by a recent increase in living wages. Inflation data for May will be published on Wednesday, revealing a significant disparity between the services and goods sectors. Prices for goods was in negative territory in April, while prices in the services sector are slowly decreasing, having fallen to only 5.9% in April, which is still quite high.

After the announcement of early elections in the UK, all speeches by Committee members were canceled, so there are no comments, and markets are relying on their own forecasts. The Conservative Party is highly likely to lose the elections to the Labour party, which would allow for a review of the budget and rate outlook. Markets are currently anticipating the first rate cut in August and will be looking for confirmation of their forecasts on Thursday, with a 60% probability of another cut this year. Two BoE cuts would correspond to two Federal Reserve rate cuts, and these expectations are already priced in, so there are no grounds for significant movements at the moment.

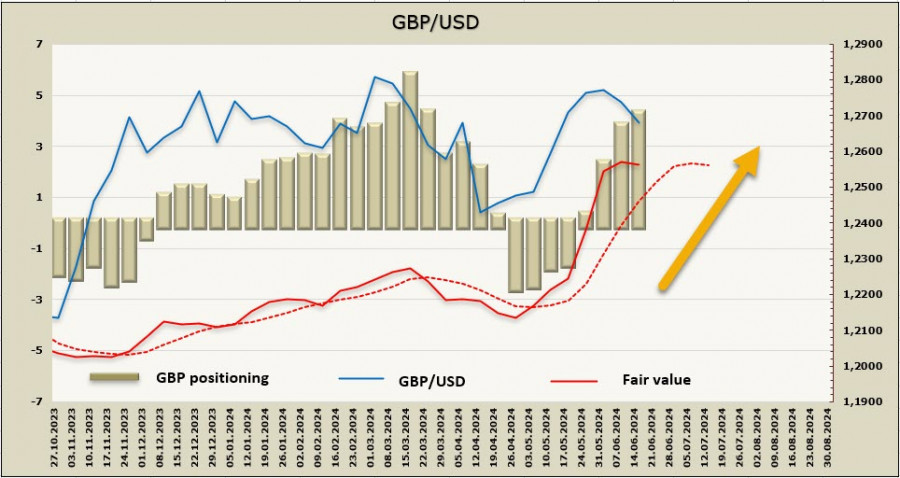

The pound is one of the few G10 currencies for which investors continued to accumulate long positions against the dollar. According to CFTC data for the reporting week, the net long position increased by $0.4 billion to $3.9 billion. Despite this, the price, primarily due to the bond market, has lost momentum and is trying to turn downwards, although it remains well above the long-term average.

A week ago, we expected the pound to rise further, but the pair followed the general trend and retreated after reaching a 3-month high, just shy of the resistance at 1.2892. The pullback was deep; however, there are few grounds for further decline unless May's inflation data brings surprises. We expect the pair to trade sideways until Wednesday, with the BoE's meeting on Thursday providing clarity on rate forecasts, after which the pound may resume its upward movement. The closest target is still the local high of 1.2892, and moving towards the next resistance at 1.3040/60 will require at least one strong factor, which may appear this week.

It's also important to consider the possibility that the Committee may take a more dovish stance, which could be reflected in the number of votes for an immediate rate cut (currently projected: 7 for maintaining the rate and 2 for an immediate cut). If this happens, the pound could become weaker and consolidate below 1.2630/45, aiming for 1.2580.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Dolar A.S. mengukuh berbanding sejumlah mata wang global, begitu juga pasaran saham A.S., selepas laporan bahawa kerajaan China sedang mempertimbangkan untuk menggantung tarif 125% terhadap beberapa jenis import A.S. Langkah

Permulaan rundingan sebenar boleh menyebabkan penurunan ketara dalam harga emas dalam masa terdekat. Dalam artikel-artikel terdahulu, saya mencadangkan bahawa harga emas yang sebelum ini meningkat dengan ketara boleh mengalami pembetulan

Pada hari Khamis, pasangan mata wang GBP/USD diniagakan lebih tinggi, kekal berhampiran paras tertinggi 3 tahun. Walaupun pound British menaik kukuh dalam beberapa bulan kebelakangan ini, pembetulan masih jarang berlaku

Pasangan mata wang EUR/USD meneruskan dagangan secara tenang pada hari Khamis, meskipun tahap volatiliti kekal agak tinggi. Minggu ini, dolar AS menunjukkan beberapa tanda pemulihan—sesuatu yang boleh dianggap sebagai satu

Analisis Laporan Makroekonomi: Beberapa acara makroekonomi dijadualkan pada hari Jumaat, tetapi ini tidak penting, memandangkan pasaran terus mengabaikan 90% daripada semua penerbitan. Antara laporan yang lebih atau kurang signifikan hari

Minggu lalu, Bank of Canada mengekalkan kadar faedah tidak berubah pada paras 2.75%, seperti yang dijangkakan. Kenyataan yang dikeluarkan bersama keputusan tersebut bersifat neutral, menekankan ketidaktentuan yang berterusan. Sukar untuk

Presiden Amerika Syarikat, Donald Trump sekali lagi memberikan komen mengenai Pengerusi Rizab Persekutuan, Jerome Powell, secara terbuka menyatakan rasa tidak puas hati dengan kadar pemotongan kadar faedah. Satu lagi ungkapan

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.