DKKJPY (Danish Krone vs Japanese Yen). Exchange rate and online charts.

Currency converter

25 Mar 2025 00:06

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

DKK/JPY is not a popular currency pair on the Forex market. DKK/JPY is the cross rate versus the U.S. dollar. Although the U.S. dollar is not obviously present in this currency pair, it still has a significant influence on it. This can be viewed, if you combine the two charts: USD/JPY and USD/DKK. By means of combining these two charts in the same price chart, you can get an approximate DKK/JPY chart.

The U.S. dollar has a strong impact on both currencies. For this reason, it is necessary to take into account the major U.S. economic indicators for the correct forecast of a future rate of this financial instrument. These data include: the discount rate, GDP, unemployment, new vacancies and many other. It is important to note that the currencies under consideration could respond to the changes in the U.S. economy at different pace. Therefore, DKK/JPY currency pair can be considered as a specific indicator of changes in these currencies.

Denmark is actively trading with the UK, its largest business partner. Denmark is a highly developed industrial-agrarian country with one of the best economic indicators in the world. This nation is rich in oil reserves that are mainly concentrated in the southern part of Jutland and on the shelves of the North Sea. However, the country is poor in minerals, which makes it reliant on imports. Denmark enjoys a durable economic relationship with all the developed countries of the world. It actively trades machinery, electronics, agriculture, mining, etc. Denmark's main trading partners are the EU countries.

Denmark has one of the most powerful economies in the world, which allows its currency to remain stable in pairs with other majors. The strong points of Denmark's economy are low inflation and unemployment, the presence of major oil and gas reserves on the North Sea shelf and in the south of Jutland, the high level of high technology development and competent professionals in all sectors of the economy.

Although Denmark has one of the most robust economies, its weaknesses are high taxes and decreasing competitiveness on world markets. If you trade GBP/DKK, you should focus on economic indicators of Denmark, as well as on the prices of oil and minerals needed to sustain Denmark's production.

The currency pair DKK/JPY is quite vulnerable to a variety of major political events and economic trends taking place in the world. That is why the price chart for the currency pair is hardly predictable, and the rate often goes in the opposite direction regardless of any analysis.

It is not advisable for novices to start their trading with the above-mentioned currency pair on the Forex market. To successfully trade this financial instrument, you need to know a lot of nuances of the price fluctuations.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread on this particular pair than on other more popular currency pairs. So, before you start working with the cross rates, you have to consider carefully the conditions offered by the broker.

See Also

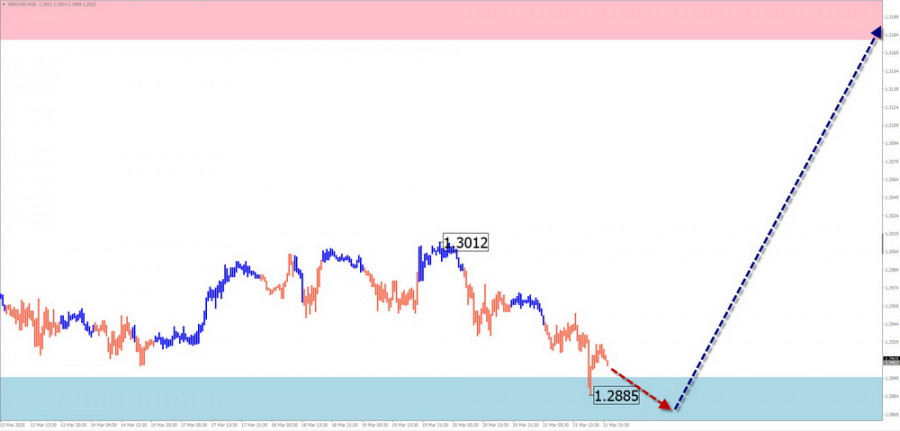

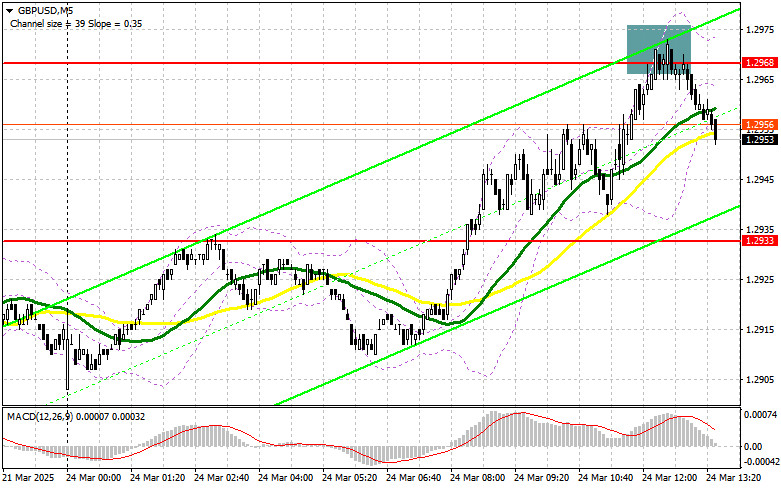

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1108

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

853

USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)Author: Jakub Novak

17:13 2025-03-24 UTC+2

838

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

838

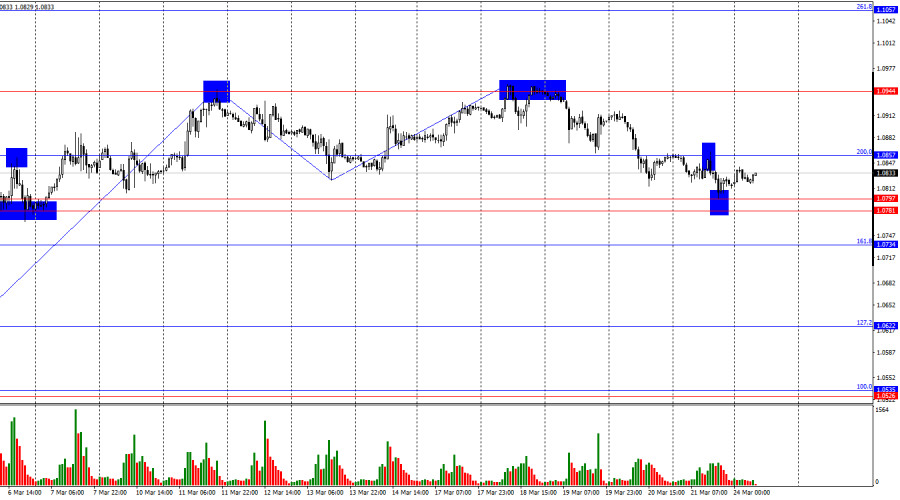

The outcomes of the Bank of England and FOMC meetings contradicted each other.Author: Samir Klishi

12:25 2025-03-24 UTC+2

793

Technical analysisTrading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

733

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

733

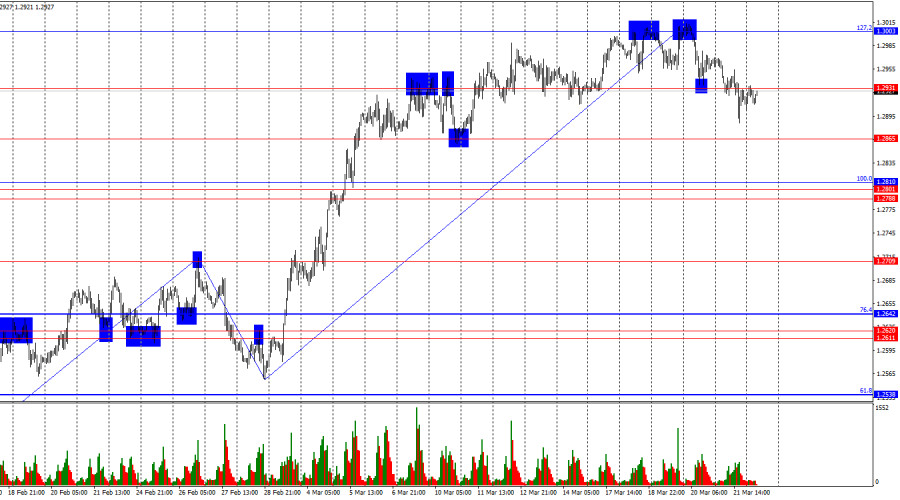

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

718

GBP/USD: Trading Plan for the U.S. Session on March 24th (Review of Morning Trades)Author: Miroslaw Bawulski

17:05 2025-03-24 UTC+2

688

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1108

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

853

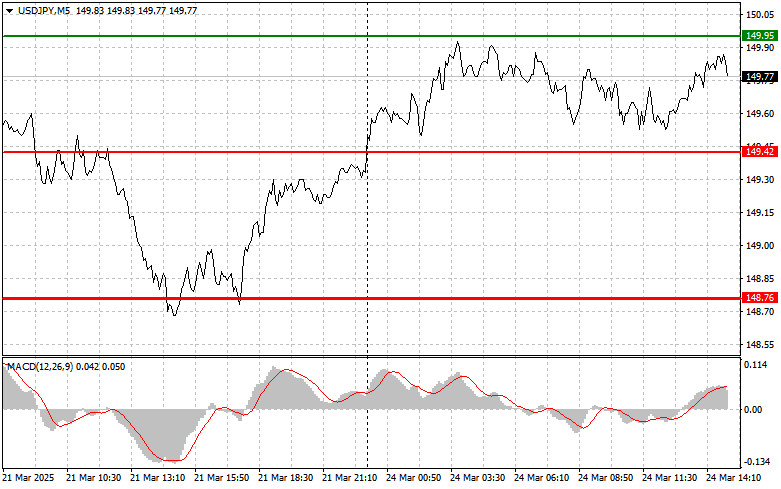

- USDJPY: Simple Trading Tips for Beginner Traders on March 24th (U.S. Session)

Author: Jakub Novak

17:13 2025-03-24 UTC+2

838

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

838

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

793

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

The eagle indicator is reaching overbought levels, so we believe a technical correction could occur in the coming days, before resuming its bullish cycle.Author: Dimitrios Zappas

17:44 2025-03-24 UTC+2

733

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

733

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

718

- GBP/USD: Trading Plan for the U.S. Session on March 24th (Review of Morning Trades)

Author: Miroslaw Bawulski

17:05 2025-03-24 UTC+2

688