Seven most magnificent palaces in the world

The prestigious magazine Architectural Digest has published a ranking of the world's most beautiful palaces. Let us take a look at the buildings that topped this list

The International Monetary Fund estimated that the current year would be the first after 2007 when all the advanced economies would record growth. Analysts consider that the wealthiest states of the world won the long-standing decline in output, financial chaos and deflation. However, economists specify that in the near future the economic crisis might happen again.

That's when the main problem lies in the way: What will they do in case of the new long-standing economic slowdown? - the question was taken up in the latest issue of The Economist from Great Britain.

The article of the publication informs that the positive dynamic is fixed by the USA — the labor market of the country is recovering. There is a simular situation in other advanced countries. Eurozone observes the reduction of unemployment, consumer prices started growing. The Japanese economy expanded by 3.9 percent year-on-year in Q1.

However, in addition to the visible positive developments, there are still a lot of unsolved problems: Europe is bound to debts and depends largely on exports, Japan is unable to recover steady inflation, the advance of wages in the United States may affect the profit of corporations, the economies of Russia, Brazilia and China are not at their best.

The Economist's experts inform that such situations are extremely rare: when large economies have no a powerful weapon against recession. The latest economic crisis took the blow from almost all resources, the remaining reserves of states are small.

Since 2007, the ratio of public debt to GDP of wealthy states has risen by an average of 50%. In the UK and Spain the debt has almost doubled. The publication notes that there is not many stocks left in the sphere of monetary policy: the United States Federal Reserve raised interest rates last time in 2006, the base rate of the London bank is 0.5% - as economists note, this is not the worst indicator, in Japan the rate is 0.1% . It is expected that with the new recession, the Central Bank will not be able to revive the economies by reduction of rates.

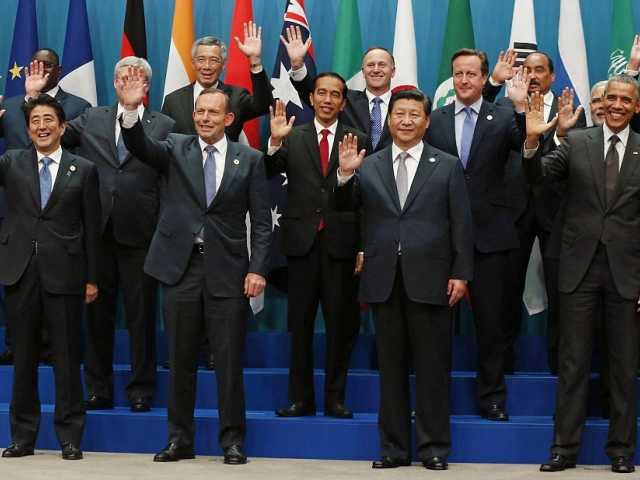

Analysts calculate: how much space for clever actions remains in the richest world economies; wonder: who has more space? According to estimates by experts, analyzing the reserve of monetary and fiscal strength of states, the maximum flexibility of the policy (it is calculated on the basis of the level of the key rate, the budget deficit and the proximity to the state debt ceiling, conventionally established by the IMF) is demonstrated by Norway, followed by South Korea, Australia is on the third place.

In summary, it should be noted that The Economist considers the desire of the states to "return to the usual, normal", as soon as possible, really understandable. However, as analysts of the publication explain, the state of the economies is still extremely fragile to realize it without regard to the future.

Experts specify that the most logical solution in their opinion would be an increase in government investments in infrastructure, the implementation of overdue reforms in the labor markets of each individual country and the establishment of more open domestic commodity markets.

The prestigious magazine Architectural Digest has published a ranking of the world's most beautiful palaces. Let us take a look at the buildings that topped this list

Winter is the perfect time to curl up in a warm blanket and enjoy drinks that bring coziness and holiday cheer. Here are seven winter drinks that are perfect for cold days

Despite the widespread belief that ultra-wealthy individuals are leaving big cities in search of privacy, most still prefer to live in bustling metropolises, according to the latest billionaire census conducted by Altrata. Let's explore which cities today have the largest concentration of people with a fortune exceeding $1 billion