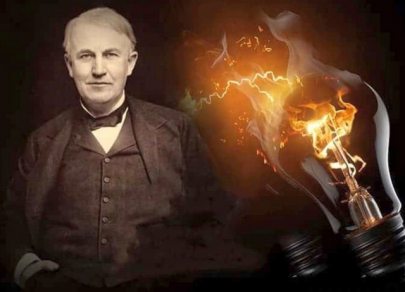

Bringing light, Internet, and AI: Innovators who transformed daily life

Throughout human history, inventions have served as catalysts for progress, accelerating societal evolution and opening new horizons for collective development. From Thomas Edison's light bulb, which dispelled darkness and spurred industrial growth, to Tim Berners-Lee's World Wide Web, which connected billions of minds in a global network of knowledge, these innovations have not only simplified daily life but have radically transformed social, economic, and cultural landscapes. Today, AI is picking up this baton, promising a new revolution in every field of human endeavor