USDCZK (US Dollar vs Czech Koruna). Exchange rate and online charts.

Currency converter

24 Mar 2025 18:35

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/CZK (US Dollar vs Czech Koruna)

USD/CZK is a currency pair traded on Forex. The behaviour of this financial instrument is very dependent on the U.S. economic situation. That is why, a trader should primarily focus on the economic indicators of the United States. Most trading activity occurs during the sessions at European and North American exchanges.

The Czech Republic is a highly developed industrial country in Central Europe; it is also one of the most prosperous and economically stable among all the countries of the region. The high rate of personal income in the Czech Republic is backed by its fast economic development.

The key sectors of the Czech Republic economy are machinery, iron and steel production, chemical industry, electronics, brewing as well as agriculture with the most developed of them being car manufacturing. Most part of the cars produced is exported. In addition, the Czech Republic is one of the leading exporters of beer and shoes. Moreover, significant portions of Czech exports are various chemical products: tires, synthetic fibers, etc. The main trade partners of the Czech Republic are Germany, Russia, Slovakia, and Austria. Because the Czech Republic has a wide range of possibilities to produce the electric power (nuclear, thermal, hydro, and solar and wind power), it is running at the forefront in electricity production in Europe.

If you trade USD/CZK, be sure to pay attention to the dynamics of other important trading instruments such as EUR/USD, GBP/USD, and USD/JPY. Since they have a great impact on the rate of the Czech national currency, they are the indicators of further USD/CZK price movement. If you trade USD/CZK, you should focus on economic indicators of the Czech Republic, as well as the oil world price and minerals that are crucial for the Czech Republic economy.

See Also

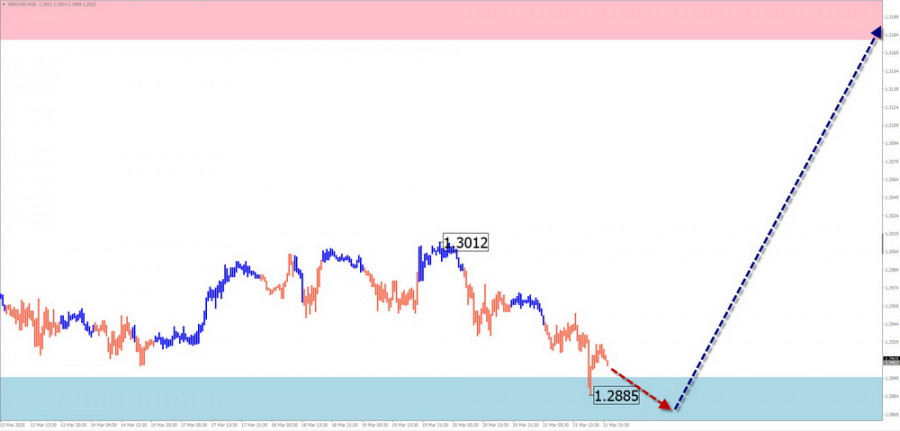

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

748

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

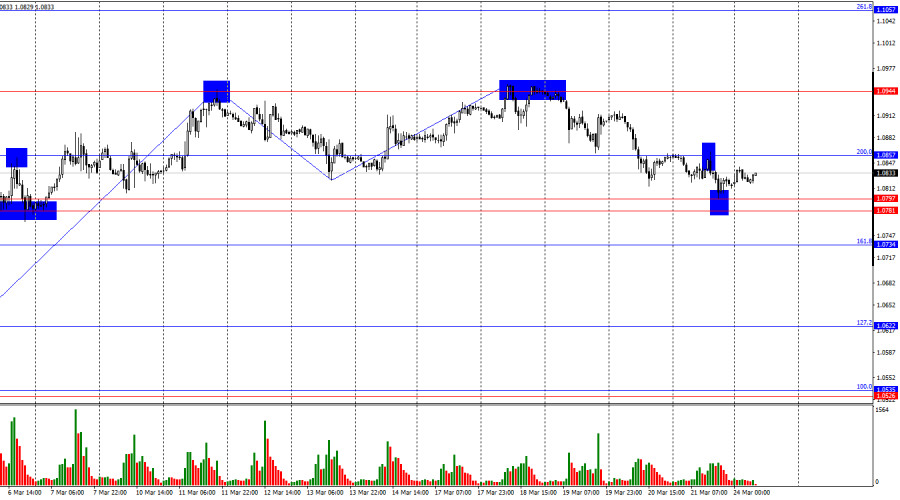

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

Dow Transports down more than 17% from November high European stocks rise ahead of PMI surveys Consumer sentiment, inflation reports next weekAuthor: Thomas Frank

11:49 2025-03-24 UTC+2

613

Friday's US trading session brought a welcome surprise for those betting on natural gas futures, while oil traders were left somewhat disappointed.Author: Andreeva Natalya

13:39 2025-03-24 UTC+2

613

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

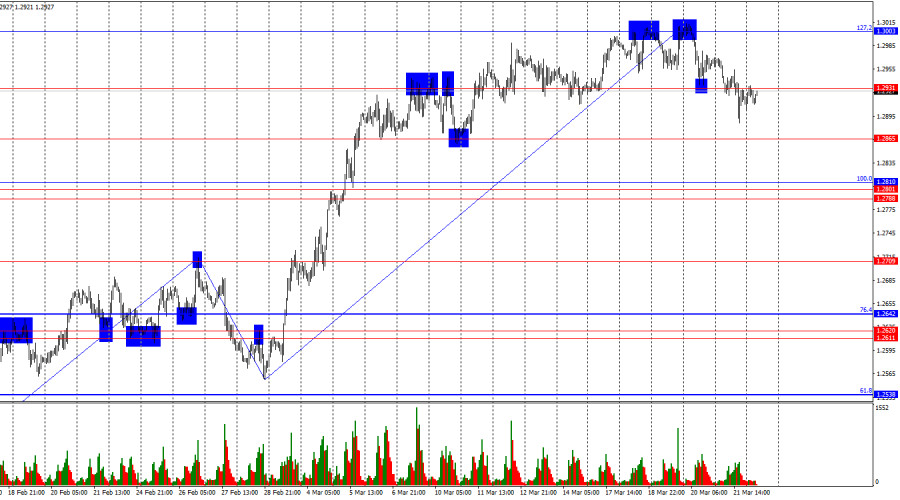

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

748

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

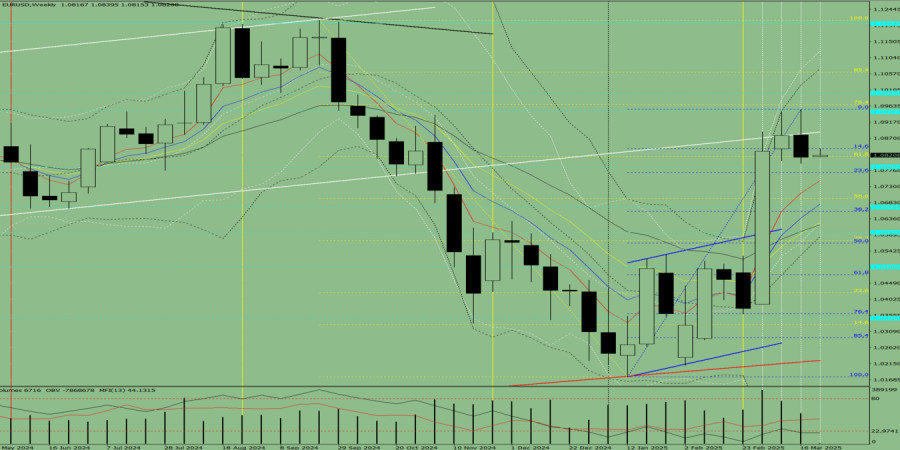

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

- Dow Transports down more than 17% from November high European stocks rise ahead of PMI surveys Consumer sentiment, inflation reports next week

Author: Thomas Frank

11:49 2025-03-24 UTC+2

613

- Friday's US trading session brought a welcome surprise for those betting on natural gas futures, while oil traders were left somewhat disappointed.

Author: Andreeva Natalya

13:39 2025-03-24 UTC+2

613