Veja também

It is becoming a tradition for Thursday to be a "black day" for the pound. Yesterday, the budget plan for the coming year was presented. The Treasury plans to raise taxes to generate an additional £40 billion and increase borrowing (QE) by £142 billion. Tax hikes will affect insurance, profits, real estate, and the energy sector. Prime Minister Keir Starmer's approval rating has hit a new low at -38, the FTSE 100 index dropped by 0.61%, and the pound sterling fell by 67 pips.

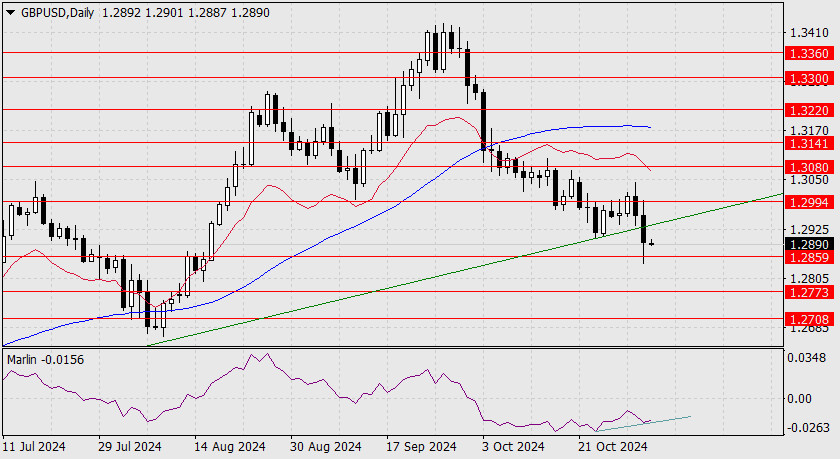

On the daily chart, the price has broken through the lower boundary of the price channel, reaching the target level of 1.2859. The price channel is now considered invalid. The resulting convergence is attempting to slow down the pound's decline. A correction is possible, as it may be wise for investors to close positions ahead of the U.S. elections.

If the price falls below yesterday's low, indicating an intention to target 1.2773, it would be a sign of reluctance among big players to reduce tension. The convergence would then remain incomplete.

On the H4 chart, the price has consolidated below the MACD line, which now acts as a cap for any potential correction (1.2916). The main scenario remains bearish.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.