Veja também

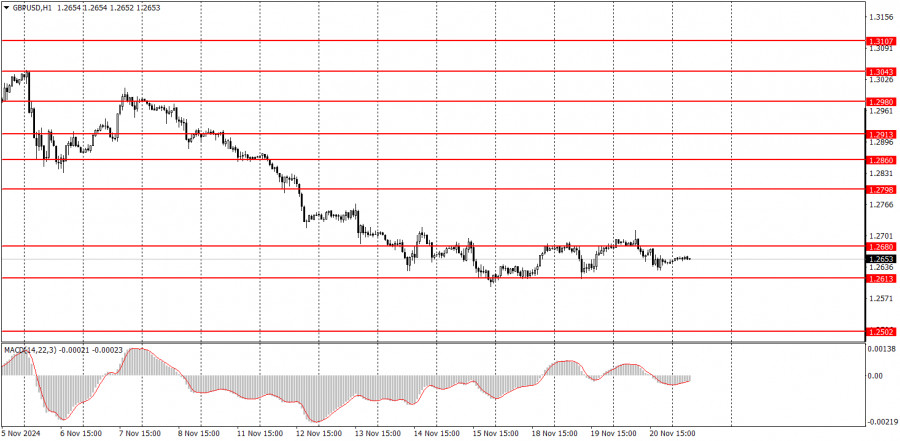

The GBP/USD pair continued to trade within a horizontal channel on Wednesday, as seen in the chart above. The British pound had an excellent opportunity to correct upward and show decent growth but failed to capitalize on it. The UK inflation report exceeded expectations, indicating that the Bank of England will now almost certainly refrain from hastily easing its monetary policy—especially given its projections for rising inflation at the end of 2024 and the beginning of 2025. However, how can the pound rise when the market refuses to buy it?

This situation does not surprise us, as the pound sterling rose for nearly two years, often without apparent justification. For two years, the market priced in just one factor: the anticipated easing of monetary policy by the Federal Reserve. Now that the Fed has initiated this cycle, the market has no factors to justify selling the U.S. dollar

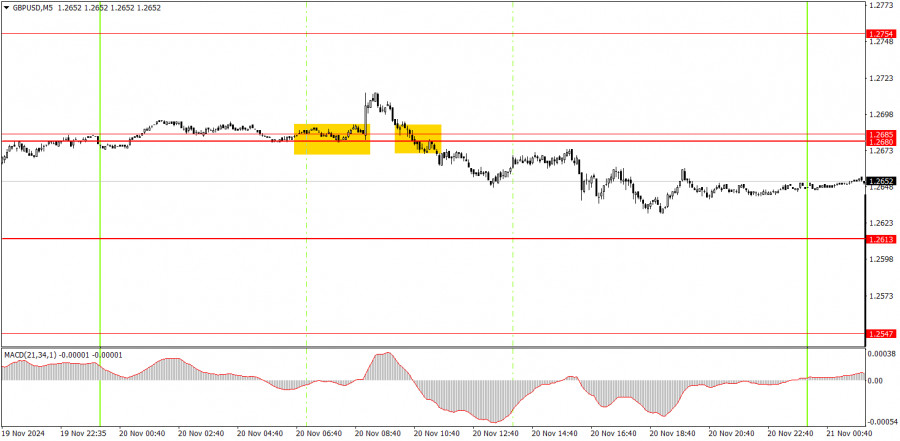

On Wednesday, two less-than-ideal signals formed on the 5-minute timeframe. The price broke above the 1.2680–1.2685 range following the release of the inflation report, and traders could reasonably expect the pound to rise. However, the market took a different approach and resumed selling the pound. As a result, the decline began, but the price failed to reach the target levels, and the drop wasn't particularly strong.

The GBP/USD pair continues to lean downward on the hourly timeframe. In the medium term, we fully support a decline in the pound, as we believe this is the only logical scenario. The pound may attempt another correction soon, but for it to materialize, the currency needs substantial support. Last Thursday, it received no support from Jerome Powell, nor did it get any boost from macroeconomic data on Friday.

On Thursday, novice traders may expect a resumption of the downward movement, but it is important to note that the pair is currently in a flat market.

On the 5-minute TF, it is now possible to trade at 1.2502-1.2508, 1.2547, 1.2633, 1.2680-1.2685, 1.2754, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993. On Thursday, no significant events are scheduled in the UK or the U.S., so expecting the flat market to end or significant volatility is likely unrealistic.

Support and Resistance Levels: Target levels for opening or closing positions. Take Profit orders can also be set here.

Red Lines: Channels or trendlines that show the current trend and the preferred trading direction.

MACD Indicator (14,22,3): A histogram and signal line that serve as supplementary trading signals.

Important Events and Reports: Found in the economic calendar, these can strongly influence price movements. During their release, trade cautiously or exit the market to avoid sharp reversals against the preceding trend.

Forex beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are critical for long-term success in trading.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Contas PAMM

da InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.