Veja também

17.03.2025 09:03 AM

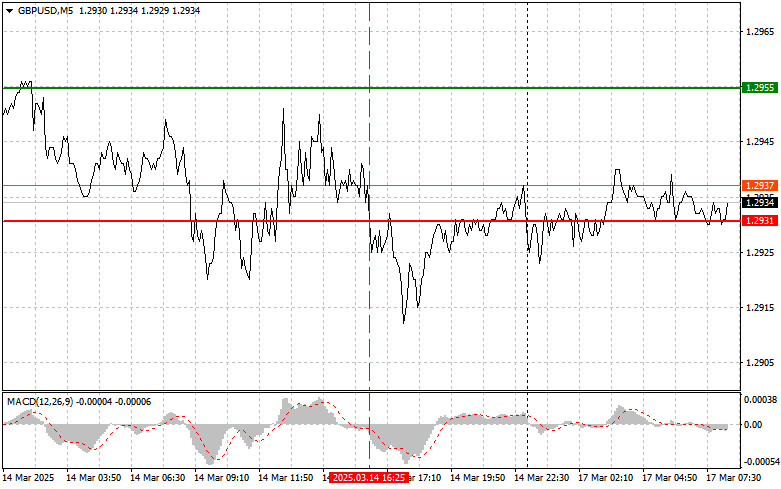

17.03.2025 09:03 AMThe price test at 1.2931 occurred when the MACD indicator moved significantly downward from the zero mark, limiting the pair's downside potential. For this reason, I did not sell the pound and did not find any other entry points into the market.

Despite relatively weak UK GDP and industrial production data, the British pound held its ground against the dollar. This is due to several factors. First, investors seem to be betting that the Bank of England will be less aggressive in cutting interest rates as it continues its fight against inflation. Second, the weakness of the US dollar is providing additional support for the GBP/USD pair. Concerns over a slowdown in the US economy and the potential for further interest rate cuts by the Federal Reserve are reducing the dollar's appeal.

There are no economic reports from the UK today, so the pound could resume its growth at any moment. Tired of uncertainty, investors might decide that the worst is over and start buying the British currency again, especially if they see signs of economic stabilization. A hawkish stance from the BoE could also support the pound.

For intraday strategy, I will primarily rely on Scenarios #1 and #2.

Scenario #1: Today, I plan to buy the pound if the entry point reaches around 1.2941 (green line on the chart), targeting an increase to 1.2970 (thicker green line on the chart). Around 1.2970, I plan to exit buy positions and open sell trades in the opposite direction, expecting a 30-35 pip move downward from this level. The pound's growth will likely continue in line with the upward trend. Important! Before buying, ensure that the MACD indicator is above the zero mark and has just started rising.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2925 price level while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. Growth to the opposite levels of 1.2941 and 1.2970 can be expected.

Scenario #1: Today, I plan to sell the pound after it breaks below 1.2925 (red line on the chart), likely leading to a rapid decline in the pair. The key target for sellers will be 1.2898, where I plan to exit my sell positions and immediately open buy trades in the opposite direction, expecting a 20-25 pip rebound from this level. It is best to sell the pound as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and has just started declining.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.2941 price level while the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a market reversal downward. A decline to the opposite levels of 1.2925 and 1.2898 can be expected.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Análise das operações e recomendações para negociar a libras esterlina O teste de preço em 1,3116 ocorreu quando o indicador MACD havia acabado de iniciar um movimento descendente a partir

Vídeo de treinamento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.