CADNOK (Canadian Dollar vs Norwegian Krone). Exchange rate and online charts.

Currency converter

24 Mar 2025 15:47

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CAD/NOK is quite popular currency pair on Forex. CAD/NOK represents the cross rate against the U.S. dollar. Although the greenback cannot be observed within this pair, it still has a great impact on it. If the CAD/USD and USD/NOK price charts are combined, the CAD/NOK chart is received.

The U.S. dollar has a significant influence on both the Canadian dollar and the Norway kroner. Thus, it is necessary to consider the U.S. major economic indicators to predict the future CAD/NOK moves correctly. These indicators include: the discount rate, GDP, unemployment, new created workplaces indicator, and many others. However, the mentioned above currencies could respond differently to the changes in the U.S. economy. Thus, CAD/NOK may be a specific indicator of change at these currencies.

Canadian dollar is very dependent on world oil prices. Canada is one of the world largest exporters of oil. For this reason, with increasing oil price, the Canadian dollar is also increasing. On the other hand, if oil prices fall, the cost the Canadian dollar is falling, too. In such a way, CAD/NOK depends mainly on oil world prices.

Norway is one of the leading industrial-agrarian countries. The country takes the leading positions in the quality of life and personal income level. Norway is the third largest producer and exporter of oil and gas. The main source of income of this Scandinavian country is the export of energy resources. In addition, Norway is among top countries in electrometallurgy, electrical engineering, mechanical engineering, etc. In addition, the Norwegian industry is a leading manufacturer of offshore drilling platforms for oil and gas. Also, Norway’s fishing and aquaculture industry supplies seafood, which is in high demand worldwide, especially in the European countries.

This trading instrument is relatively illiquid compared with EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you analyze CAD/NOK, you should primarily focus on those currency pairs that include the U.S. dollar.

It is necessary to remember that brokers usually set a higher spread for cross rates, so before trading them, read and understand the conditions offered by the broker carefully.

See Also

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1153

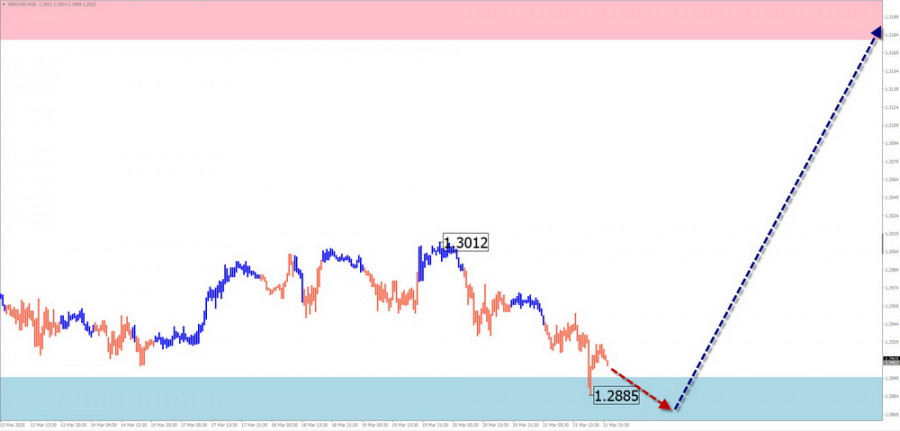

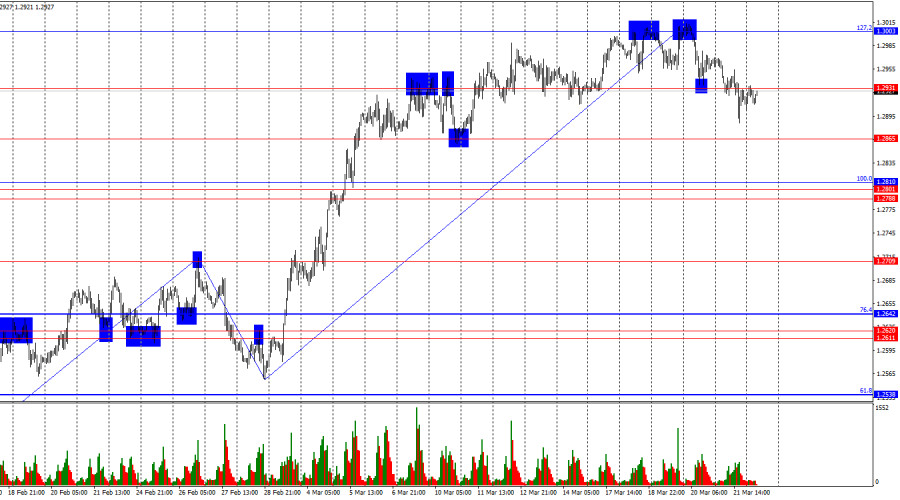

Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.Author: Stefan Doll

14:24 2025-03-24 UTC+2

1048

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

718

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

718

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

703

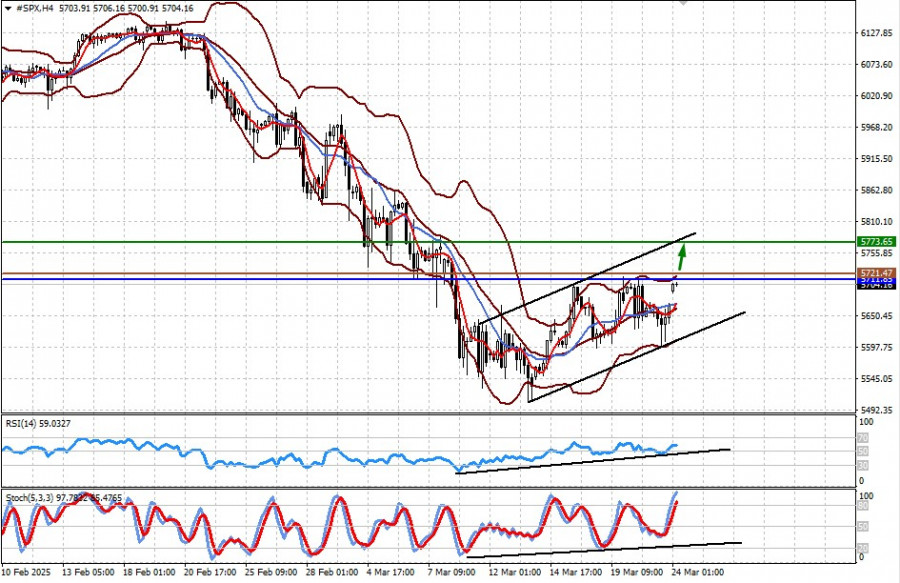

Fundamental analysisMarkets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

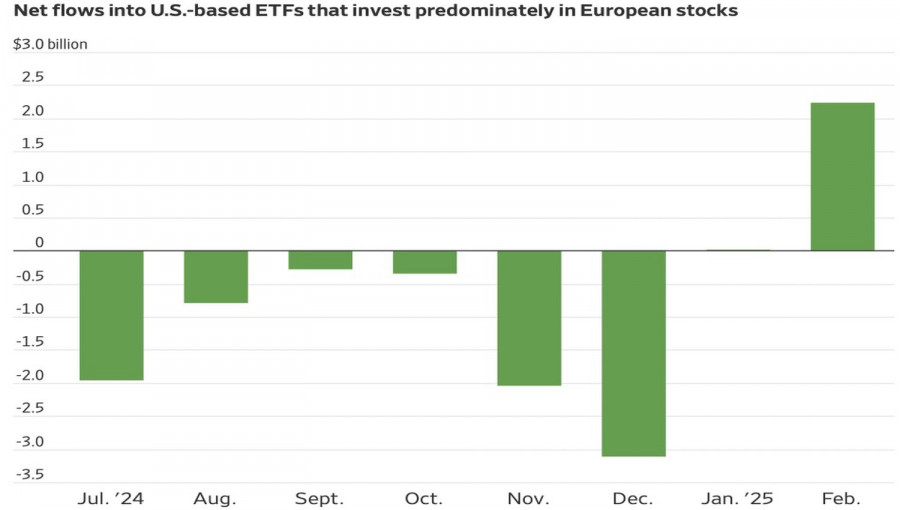

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

Trading Recommendations for the Cryptocurrency Market on March 24Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Author: Irina Yanina

11:25 2025-03-24 UTC+2

1153

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1048

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

718

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

718

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

703

- Fundamental analysis

Markets Are Tired of Falling. Investors Look for Growth Triggers (CFD contracts on #SPX and #NDX futures may rise on positive U.S. economic data)

Global financial markets continue to swing back and forth amid uncertainty over the actual impact on the economies of various countries targeted by Donald Trump's tariff hikes, which have prompted retaliatory measures in returnAuthor: Pati Gani

10:23 2025-03-24 UTC+2

643

- White House tariffs bring more pain to the U.S. than to other regions

Author: Marek Petkovich

10:23 2025-03-24 UTC+2

643

- Trading Recommendations for the Cryptocurrency Market on March 24

Author: Miroslaw Bawulski

09:54 2025-03-24 UTC+2

643