HUFJPY (Hungarian Forint vs Japanese Yen). Exchange rate and online charts.

Currency converter

24 Mar 2025 18:34

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

HUF/JPY is not a popular pair on Forex. It represents the cross rate against the U.S. dollar which has a significant influence on it. Thus, combining the USD/JPY and USD/HUF price charts, a trader can get an approximate HUF/JPY price chart.

As the U.S. dollar has a great impact on both currencies, it is necessary to consider the major economic indicators of the USA to predict the future movements of the pair. Such indicators may include the discount rate, GDP growth, unemployment rate, new vacancies, and many others. However, it should be noted that the currencies can respond with different speed to the changes in the U.S. economy, being a specific indicator of HUF/JPY.

The liquidity of this trading instrument is very low as compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you make a projection for this financial instrument, you should primarily focus on USD/JPY and USD/HUF.

HUF/JPY currency pair is very susceptible to a variety of major political and economic changes taking place in the world. Thus, the price chart for this currency pair is poorly predictable and often goes in the opposite direction relatively to any analysis.

It is not recommended for the newbies to start their trading activity on the currency market with HUF/JPY. For successful trading on this financial instrument you need to know a lot of nuances of price chart behavior that can greatly affect the future course rate.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread for popular currency pairs. Therefore, before you start working with the cross rates, read carefully the terms and conditions offered by the broker.

See Also

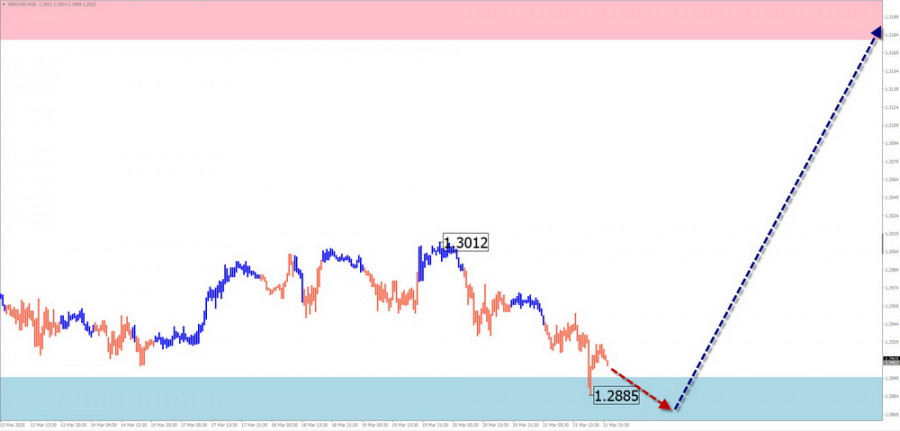

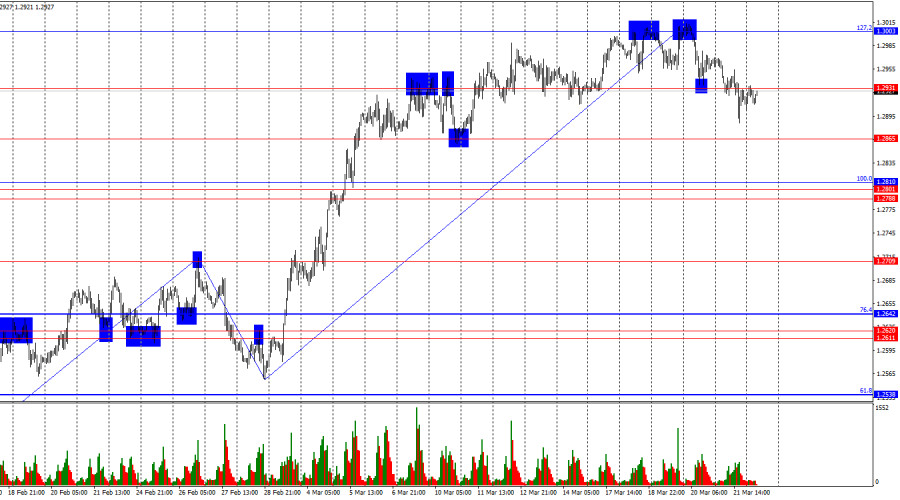

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

Technical analysis / Video analyticsForex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

748

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

Wave analysisWeekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

The bulls attacked for two weeks, but now it's time for a pause.Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

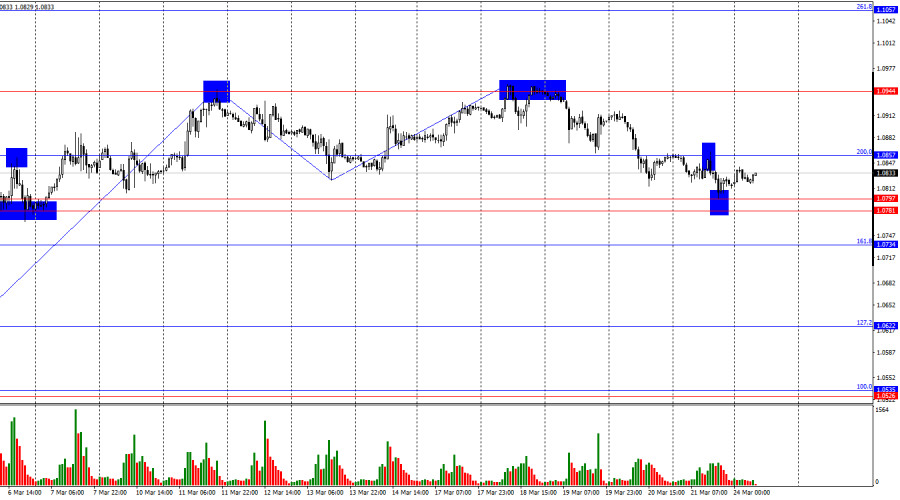

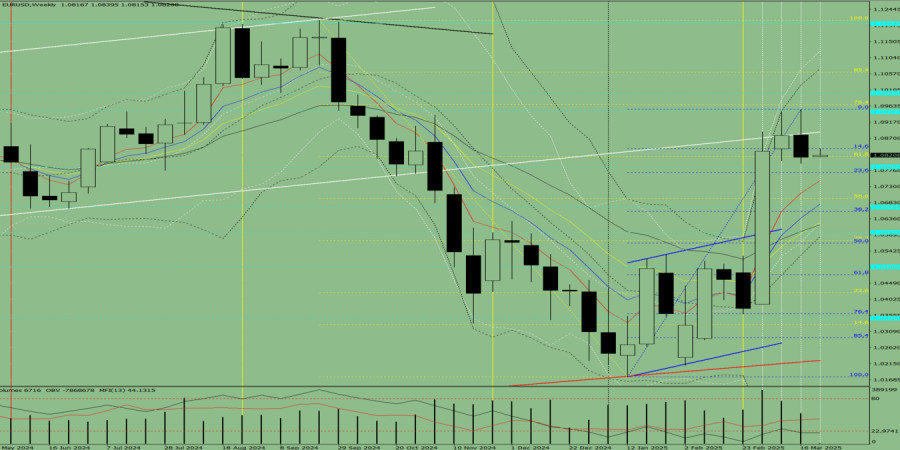

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

Dow Transports down more than 17% from November high European stocks rise ahead of PMI surveys Consumer sentiment, inflation reports next weekAuthor: Thomas Frank

11:49 2025-03-24 UTC+2

613

Friday's US trading session brought a welcome surprise for those betting on natural gas futures, while oil traders were left somewhat disappointed.Author: Andreeva Natalya

13:39 2025-03-24 UTC+2

613

- Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:24 2025-03-24 UTC+2

1063

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, #Ethereum, #Litecoin – March 24th

In the coming days, GBP is expected to move sideways with a flat bias. Pressure on the lower boundary of the support zone is possible, followed by stabilization and the formation of reversal conditions.Author: Isabel Clark

12:21 2025-03-24 UTC+2

763

- Technical analysis / Video analytics

Forex forecast 24/03/2025: EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Gold and Bitcoin.Author: Sebastian Seliga

15:34 2025-03-24 UTC+2

748

- The outcomes of the Bank of England and FOMC meetings contradicted each other.

Author: Samir Klishi

12:25 2025-03-24 UTC+2

733

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis: EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, #Ripple – March 24th

A continuation of the overall sideways movement of the euro is expected in the coming week, fluctuating between the nearest opposing zones. A downward vector is more likely in the early days.Author: Isabel Clark

12:13 2025-03-24 UTC+2

718

- The bulls attacked for two weeks, but now it's time for a pause.

Author: Samir Klishi

13:55 2025-03-24 UTC+2

688

- Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815. In the upcoming week, the price may continue moving upward.

Author: Stefan Doll

14:22 2025-03-24 UTC+2

643

- Dow Transports down more than 17% from November high European stocks rise ahead of PMI surveys Consumer sentiment, inflation reports next week

Author: Thomas Frank

11:49 2025-03-24 UTC+2

613

- Friday's US trading session brought a welcome surprise for those betting on natural gas futures, while oil traders were left somewhat disappointed.

Author: Andreeva Natalya

13:39 2025-03-24 UTC+2

613