Vea también

03.08.2023 01:43 PM

03.08.2023 01:43 PMThe cryptocurrency market and Bitcoin have undergone significant changes after the Fed's decision on its key interest rate in the July meeting. The cryptocurrency broke through $30,000 and entered a new price range of $28,500-$29,700. Bulls have been trying to regain control and push the price above $30,000, but they barely succeeded.

The recent bullish momentum occurred on August 1 when bulls defended the key support level at $28,500. The price formed a bullish engulfing pattern and reached the psychological level of $30,000. However, the bullish momentum could not be sustained as bears managed to absorb the buying volumes and push the price back into the range of $28,500-$29,700 on August 2.

The economic situation in the US has historically influenced Bitcoin due to the Fed's policies regulating global economic liquidity. The recent drop in BTC/USD quotes was also tied to the economic situation in the US. The downgrade of the world's largest economy's credit rating to AA+ and statements from the US Treasury Secretary led to a significant strengthening of the USD index and a 4% rise in Treasury bonds.

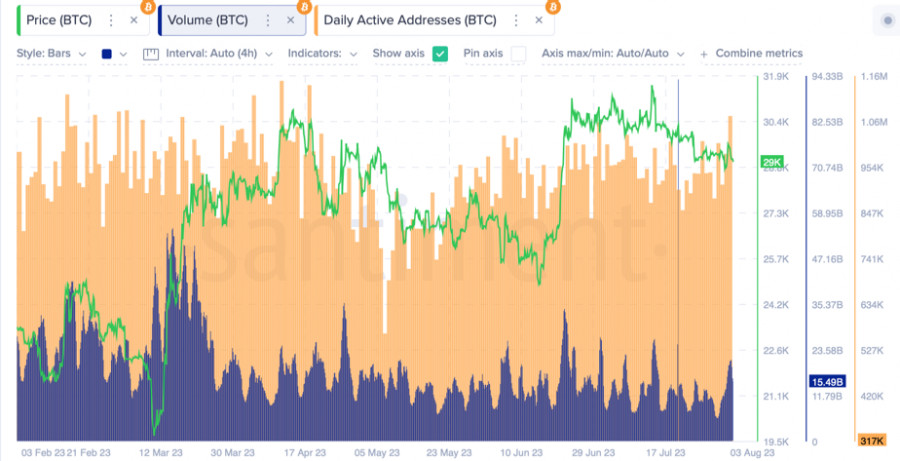

This, in turn, caused a decline in most financial instruments, including BTC. As of August 3, the cryptocurrency is trading at $29,100 with trading volumes nearing $14 billion. Analysts from Grayscale suggest that the crypto market's prospects depend on the likelihood of a recession in the US. At the same time, Fannie Mae believes this may occur by the end of 2023.

In the short term, the situation around Bitcoin does not look optimistic due to the successful earnings season. As per Compound's data, 58% of S&P 500 companies have already reported on SP&500 EPS showing an 8% year-over-year growth, which led to reduced trading activity in the crypto market.

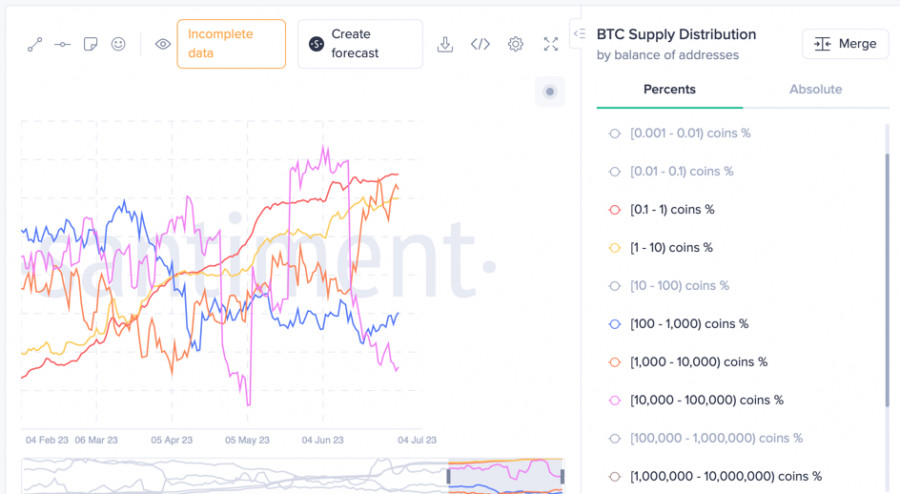

Despite the temporary market calm, the fundamental value remains strong, as evidenced by the continued active accumulation of BTC volumes by major investors. Whales, in particular, have resumed accumulation, which often leads to significant price movements. Overall, the number of BTC addresses with non-zero balances has reached a record 47.9 million.

However, short-term profit-taking by individual traders and whales selling over 250,000 BTC negatively affected the price movement. Mainstream holders are now dealing with the consequences of these actions.

Regarding the BTC/USD pair, there was an impulsive movement aimed at establishing a price above the range of $30,000-$30,200, but it occurred with declining volumes, indicating a lack of strong buyers. The recent price decline to the current levels happened with increasing bearish volumes, leading to a bearish engulfing pattern.

The market remains bearish, and Bitcoin is expected to continue moving within the range of $28,500-$29,700, testing the lower boundary. The main short-term targets for bears are located near $28,500 and $27,500, while bulls aim to solidify above the area of $30,000-$30,200, although their efforts are hindered by low volumes.

Despite the bearish sentiment, there might be another bullish momentum by the end of the current week, as bulls have shown resistance despite the bears' strength. Market data, along with potentially positive reports from AAPL/AMZN, could provide a new impulse to the BTC market.

Bitcoin continues to react strongly to macroeconomic data related to the Fed's policies and inflation. The publication of key macroeconomic indicators always triggers volatility and significant price reactions. In the short term, low trading volumes and investors focus on the stock market's earnings season influence the consolidation movement of BTC. The outlook is bearish, with at least one test of $28,500, and further declines are possible.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El Ethereum apenas logró recuperarse hasta el FVG más cercano y durante dos semanas no pudo seguir subiendo. Sin embargo, el Bitcoin finalmente arrastró hacia arriba a su "hermano menor"

El Bitcoin continuó su movimiento ascendente el martes, lo que generó muchas preguntas. Sin embargo, recordemos que el análisis técnico no puede proporcionar señales con una precisión del 100% todo

El Bitcoin se activó durante el pasado fin de semana, sin que hubiera razones ni fundamentos concretos para ello. Simplemente el mercado volvió a lanzarse a comprar la primera criptomoneda

El Bitcoin y el Ethereum permanecen dentro de sus canales laterales y la incapacidad para salir de estos rangos podría poner en peligro las perspectivas de una recuperación más amplia

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.