Vea también

Bitcoin dropped to $87,000 from its peak of $93,000, triggering liquidations worth $120 million. The over 4% decline, driven by profit-taking on Thursday evening, was an expected market reaction following several days of frenzied growth. Ethereum and Solana dropped by 3.5%, while Dogecoin and SHIB lost as much as 5%.

Federal Reserve Chairman Jerome Powell's hawkish comments in his latest speech triggered this downturn. These comments dampened hopes for a faster rate cut this year. Economists now assess the probability of a policy easing in December at just 55%, down from 88% before Powell's address.

"The economy is giving us no indication that we need to rush into rate cuts," Powell said in prepared remarks at a Dallas conference. "The current economic situation allows us to approach decision-making cautiously."

The CoinDesk 20 Index (CD20), which tracks the largest tokens by market capitalization, mainly remained unchanged. Despite the correction, the potential for the bull market to continue remains strong.

As for the intraday strategy on the cryptocurrency market, I plan to capitalize on major pullbacks in Bitcoin and Ethereum, anticipating a continuation of the bullish market trend, which has remained intact.

Below are the short-term trading strategies and conditions:

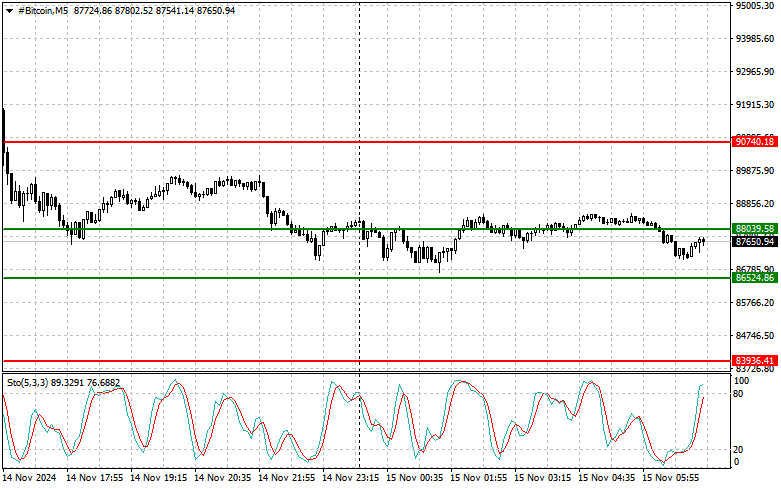

Buy Scenario:

I will buy Bitcoin today at the entry point of $88,040, targeting growth to $90,740. Around $90,740, I will exit purchases and sell on a rebound. Before buying on the breakout, ensure the Stochastic Indicator is near the lower boundary, around the 20 level.

Sell Scenario:

I will sell Bitcoin today at the entry point of $86,540, targeting a decline to $83,900. Around $83,900, I will exit sales and buy on a rebound. Before selling on the breakout, ensure the Stochastic Indicator is near the upper boundary, around the 80 level.

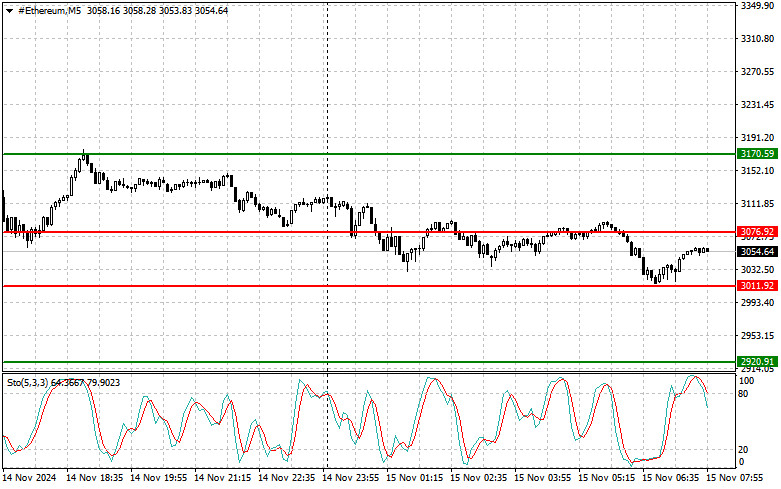

Buy Scenario:

I will buy Ethereum today at the entry point of $3,076, targeting growth to $3,170. Around $3,170, I will exit purchases and sell on a rebound. Before buying on the breakout, ensure the Stochastic Indicator is near the lower boundary, around the 20 level.

Sell Scenario:

I will sell Ethereum today at the entry point of $3,011, targeting a decline to $2,920. Around $2,920, I will exit sales and buy on a rebound. Before selling on the breakout, ensure the Stochastic Indicator is near the upper boundary, around the 80 level.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.