Vea también

A few macroeconomic events are scheduled for Thursday, and almost none are particularly significant. Germany will release the GfK Consumer Confidence Report in the Eurozone, which is considered entirely secondary. Apart from the Bank of England meeting in the UK, there are no notable events. The GDP report for Q3 (third estimate) and a few secondary reports, such as jobless claims, are due in the US. Out of all these, only the GDP report has the potential to influence market sentiment. However, it's important to note that the FOMC meeting held last night may continue to impact trading throughout the day. The BoE meeting today could also influence the EUR/USD pair.

The key fundamental event on Thursday is the BoE meeting. Although the market expects rates to remain unchanged, the reaction could still be significant. Last night, the market was prepared for the Federal Reserve's decision, but the dot-plot chart triggered a strong rally in the dollar. Today, a significant movement could arise depending on the results of the vote on the rate among members of the Monetary Policy Committee.

On the fourth trading day of the week, the British pound could continue its "flight" of volatility. The market may still be digesting the outcomes of the Fed meeting while simultaneously reacting to the results of the BoE meeting. In the medium term, we remain committed to the outlook of further declines in both the euro and the pound, but today, both European currencies could see some gains. Everything will hinge on the tone and decisions of the BoE.

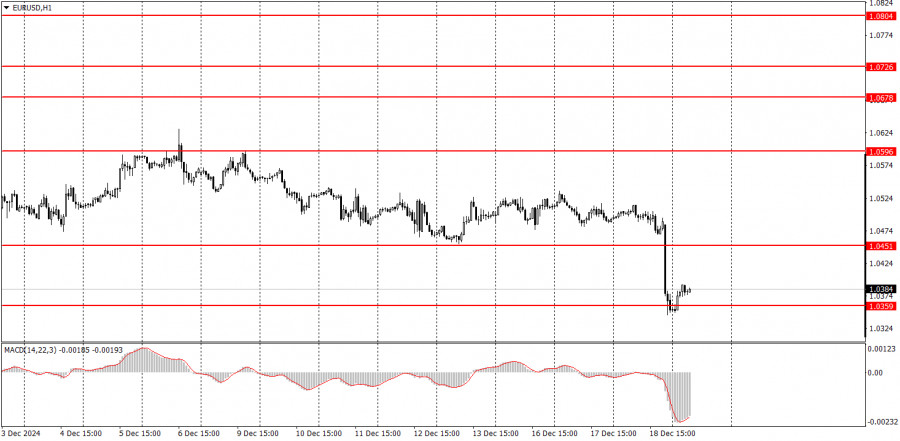

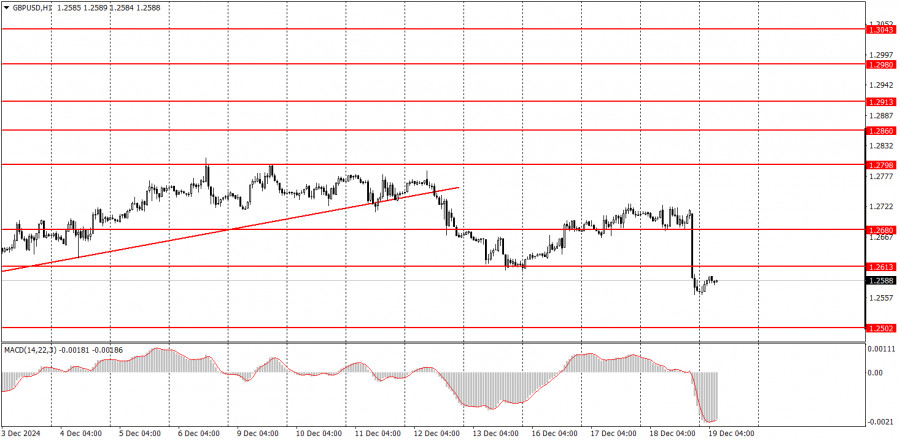

Support and Resistance Levels: Targets for opening buy or sell orders. These are ideal points for setting Take Profit levels.

Red Lines: Trendlines or channels reflecting the current trend direction and indicating the preferred trading direction.

MACD Indicator (14,22,3): A histogram and signal line serving as auxiliary indicators and sources of signals.

Key News Events and Reports: Always listed in the economic calendar, these can significantly impact currency pair movements. Exercise caution or exit the market during such events to avoid sharp price reversals.

Every trade cannot be profitable. The key to long-term success in Forex trading lies in developing a clear strategy and effective money management.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Gráfico Forex

versión web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.