Vea también

05.03.2025 10:27 AM

05.03.2025 10:27 AMHong Kong Stocks Lead Gains as China Sets Growth Target

Hong Kong stocks led today's rally as China's GDP target fueled expectations for increased economic stimulus. According to reports from the National People's Congress in Beijing, China has maintained its growth target at around 5% for 2025—marking the third consecutive year with the same goal. Given rising global uncertainty surrounding tariffs and geopolitical risks, economists now anticipate stronger policy support from Chinese officials.

Additionally, China has widened its budget deficit to the highest level in 30 years as it battles deflation, a collapsing real estate market, and now an escalating trade war with the U.S.. Policymakers also lowered their inflation target to 2%, down from the long-standing 3% benchmark. Following these announcements, the yuan weakened slightly.

Trade War Uncertainty and Trump's Stance on Tariffs

In his State of the Union address, Trump acknowledged that a transition period for tariffs might be necessary, defending his economic restructuring policies. He also called for an end to the $52 billion semiconductor subsidy program, while once again emphasizing the importance of 25% tariffs on aluminum, copper, and steel. His speech coincided with new data showing a slowdown in economic activity, attributed to uncertainty stemming from the global trade war.

The situation is further complicated by Trump's erratic trade policy—one day imposing tariffs, the next day hinting at their removal, and then threatening new trade wars soon after.

Yesterday, Lutnick's comments suggesting a potential tariff compromise with Canada and Mexico, along with Germany's plan to boost defense spending, temporarily lifted market sentiment. However, the euphoria was short-lived. U.S. Treasury yields declined on Tuesday, while the dollar continued to weaken against all G10 currencies.

Later today, the U.S. is expected to announce a plan for potential tariff exemptions on Mexican and Canadian goods covered by the North American Free Trade Agreement (NAFTA).

Germany's Shift on Defense Spending Fuels Risk Appetite

Germany announced plans to unlock hundreds of billions of euros for defense and infrastructure investments, marking a dramatic policy shift that abandons its long-standing commitment to fiscal restraint. This move boosted demand for risk assets, driving a recovery in global currency markets.

Commodities and Cryptocurrencies: Oil Falls, Gold Stabilizes

In commodities, oil extended its decline, while gold stabilized near record highs. Meanwhile, Bitcoin fluctuated between gains and losses, struggling to find direction.

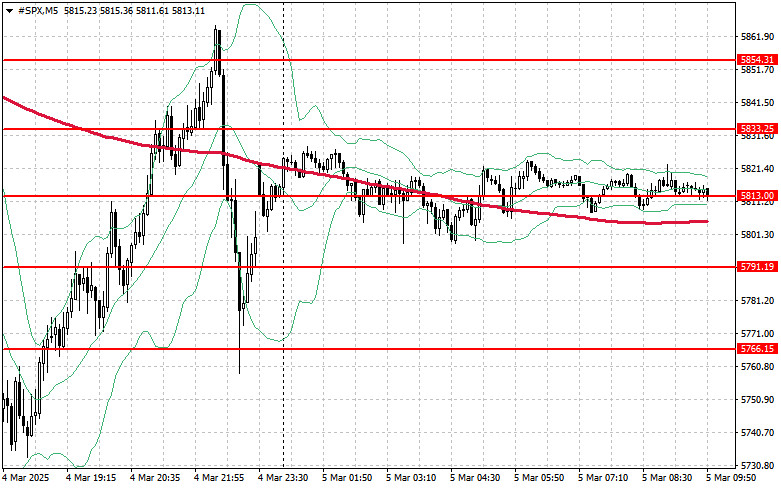

Technical Outlook for S&P 500

The downtrend remains intact for the S&P 500. Today, buyers must push past the nearest resistance at $5833 to sustain a rebound. A breakout above this level could trigger further gains toward $5854. Another key level to watch is $5877, as controlling this zone would strengthen bullish positions.

If risk appetite weakens and sellers regain control, buyers must defend support at $5813. A break below this level could drive the index down to $5791, opening the door for a further decline toward $5766.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Al cierre de la última sesión regular, los índices bursátiles estadounidenses finalizaron al alza. El S&P 500 subió un 1,67% y el Nasdaq 100 avanzó un 2,50%. El Dow Jones

Al cierre de la última sesión regular, los índices bursátiles estadounidenses terminaron en caída. El S&P 500 cayó un 2,36%, el Nasdaq 100 descendió un 2,45% y el Dow Jones

Al final de la última sesión regular, los índices bursátiles estadounidenses cerraron de forma mixta. El S&P 500 subió un 0,13%, mientras que el Nasdaq 100 cayó un 0,13%

Según los resultados de la última sesión regular, los índices bursátiles estadounidenses cerraron de manera mixta. El S&P 500 subió un 0,13%, mientras que el Nasdaq 100 cayó un 0,13%

Al cierre de la última sesión regular, los índices bursátiles estadounidenses registraron una fuerte caída. El S&P 500 cayó un 2,24%, mientras que el Nasdaq 100 descendió un 3,07%

Tras los resultados de la última sesión regular, los índices bursátiles estadounidenses cerraron con crecimiento. El S&P 500 subió un 1,81%, mientras que el Nasdaq 100 sumó un 2,06%

Al cierre de la sesión regular de ayer, los índices bursátiles estadounidenses terminaron con una fuerte alza. El S&P 500 subió un 9,52%, mientras que el Nasdaq 100 se disparó

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.